Amazon Pay for Business: Enhance Efficiency with Cointab’s Reconciliation

Amazon Pay for Business: Enhance Efficiency with Cointab’s Reconciliation

In today’s digital landscape, Amazon Pay has become a widespread presence, empowering online businesses with a comprehensive payment solution. Owned by the world-renowned Amazon, this secure service offers a robust suite of functionalities beyond just simplifying Amazon purchases. Businesses can leverage Amazon Pay to:

- Facilitate Seamless Payments: Accept customer payments with ease through a trusted and widely recognized platform, reducing cart abandonment and boosting customer satisfaction.

- Consolidate Bill Payments: Streamline the management of utility bills, subscriptions, and recurring expenses for your team, ensuring timely payments and minimizing late fees.

- Offer Mobile Top-Ups: Provide convenient mobile recharge options for your employees or customers, all within the familiar Amazon Pay interface.

- Centralize Insurance Management: Gain centralized control over business insurance policies, facilitating effortless renewals and fostering clear visibility into coverage details.

Many businesses partner with Amazon Pay as a payment gateway partner but Amazon Pay requires a fee and tax to be paid on each payment in order to access its services. It could be exceedingly challenging for businesses to track the fees and taxes incurred for each order and keep track of the final amount settled in the bank.

The Challenge of Fee Management: Undetected Costs and Time-Consuming Reconciliation

While Amazon Pay simplifies financial operations, manually tracking associated fees, taxes, and settlements can quickly become a significant burden. Inaccurate calculations and tedious reconciliation processes often lead to frustration and wasted time.

- Undetected Fee Risks: Inaccurate fee calculations can result in overpayments, subtly diminishing your profits.

- Time-Consuming Reconciliation: Manual verification of fees, taxes, and settlements is a laborious and error-prone task.

Empower your finance team with Cointab's automated reconciliation. Get started today!

Sign Up For Demo

Imagine a world free from manual calculations and endless spreadsheets. Our automated Cointab reconciliation software ensures secure and accurate Processing of Your Amazon Pay Transactions and streamlines the previously cumbersome task of navigating complex spreadsheets. saving you valuable time and ensuring financial peace of mind. Our innovative software tackles these challenges head-on by offering automated Amazon Pay reconciliation. This solution empowers businesses to:

- Minimize Costs: Identify and rectify any discrepancies in fees or taxes charged by Amazon Pay, preventing overpayments and maximizing profitability.

- Free Up Resources: Eliminate the time and effort required for manual reconciliation, allowing your finance team to focus on core business strategies.

- Gain Enhanced Visibility: Obtain a comprehensive overview of all Amazon Pay transactions with clear insights into fees, taxes, and settlements, facilitating informed financial decision-making.

Amazon Pay Payment Report: Your Transaction Ledger

This report acts as a comprehensive record, meticulously listing crucial data points for each transaction.

Transaction Amount: This field displays the exact amount processed for each transaction.

Date: In this report, check when each transaction occurred with precise date information.

Fee and Tax %: The exact percentage charged in fees and taxes for each transaction.

Payment Method: This section reveals the payment method used for the transaction (e.g., debit card, credit card).

Issuing Bank: The issuing bank associated with each transaction is mentioned here.

Amazon Pay Rate Card: Knowing Your Fee Landscape

Think of the Amazon Pay Rate Card as your roadmap to understanding fee structures. This document provides a transparent breakdown of the fees and taxes associated with Amazon Pay transactions. Key elements to keep an eye on include:

- Fee and Tax %: This section outlines the specific percentage to be charged as fees and taxes for various transactions.

- Validity Dates: It outlines the validity periods associated with the listed fees and taxes.

By referencing the rate card alongside your Amazon Pay Payment Report, you can verify that all charges adhere to the current fee structure.

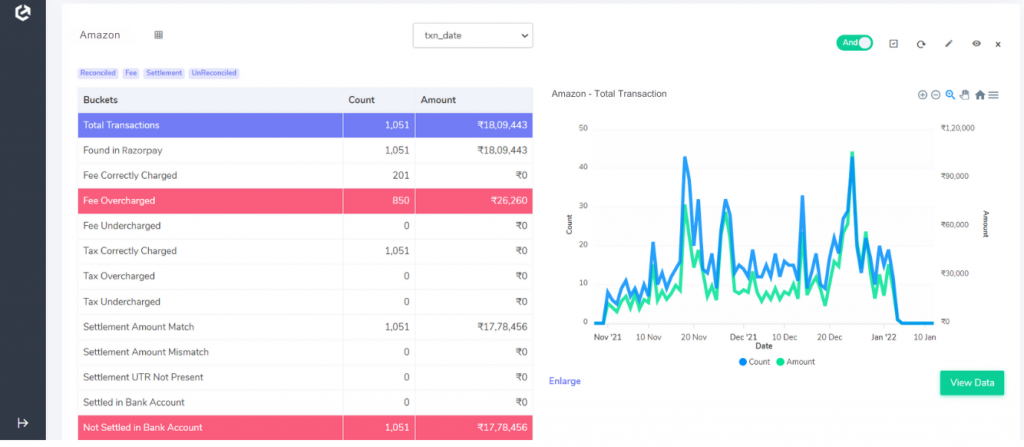

Amazon Payment Gateway Charge Verification Result:

Fee Analysis:

Fee – Correctly Charged: The fee amount charged by Amazon Pay aligns perfectly with the software’s calculated fee. This means the figures in your Amazon Pay report match your expectations.

Fee – Overcharged: The fee charged by Amazon Pay exceeds the calculated amount. This signifies a potential overcharge that requires further investigation.

Fee – Undercharged: The fee charged by Amazon Pay falls short of the calculated amount, indicating a potential undercharge by Amazon.

Tax Verification:

Tax – Correctly Charged: Your software verifies that the tax amount levied by Amazon Pay matches the calculated tax based on your contract (typically 18% GST on the fee).

Tax – Overcharged: Similar to fee discrepancies, this highlights a potential overcharge on taxes applied by Amazon Pay.

Tax – Undercharged: This scenario suggests a potential undercharge on taxes, which could lead to future tax liabilities.

Join successful businesses like our customers in optimizing your Amazon transactions with Cointab!

Join successful businesses like our customers in optimizing your Amazon transactions with Cointab!

Settlement Amount:

Settlement Amount Match: The settlement amount calculated by your software (Amount Collected from Customer – Fee Charge – Tax Charge) perfectly aligns with the settlement amount recorded in the Amazon Pay report.

Settlement Amount Mismatch: A mismatch between the calculated settlement amount and the one shown in the Amazon Pay report warrants further investigation.

Settlement UTR not present: The Unique Transaction Reference (UTR) acts as the ID for payments made to your bank. If the software cannot locate UTRs for settlements, it indicates potentially non-existent orders.

Bank Settlement:

Settled in Bank Account: The final settlement amount shown in the Amazon Pay report matches the corresponding amount recorded in your bank statement. This signifies that Amazon Pay has successfully deposited the funds for these transactions into your account.

Not Settled in Bank Account: This software alert indicates a potential delay in settlements. The software identifies orders where the settlement amount hasn’t yet been reflected in your bank statement, meaning Amazon Pay might not have completed the transfer yet.

With these insights from your reconciliation reports, you gain a comprehensive understanding of Amazon Pay fees, taxes, and settlements. This empowers you to identify discrepancies, ensure accurate charges, and maintain financial clarity for your business

By leveraging Cointab’s automated reconciliation software, businesses can achieve streamlined financial operations, eliminate extra costs, and reclaim valuable time for their finance teams. This translates to increased profitability, enhanced efficiency, and a more seamless financial reconciliation experience. Obtain a comprehensive overview of all Amazon Pay transactions with clear insights, facilitating informed financial decision-making. Contact us today and discover how Cointab can help you unlock countless possibilities using Amazon Pay for your business!