Optimizing Amazon USA Marketplace Reconciliation with Cointab

Optimizing Amazon USA Marketplace Reconciliation with Cointab

The vast reach and established infrastructure of Amazon, a global e-commerce leader, make it a magnet for businesses seeking to expand their online sales.

Leveraging Amazon’s expansive marketplace presents a compelling opportunity for businesses to achieve substantial growth and profitability within the e-commerce landscape. However, financial management is paramount to ensure a business’s success on the platform. Reconciling accounts within the Amazon USA marketplace presents a unique challenge due to several factors. Firstly, the intricate fee structure, with diverse fees applied to each order, necessitates a granular level of analysis. Secondly, the sheer volume and variety of data reports generated by Amazon, encompassing payments, taxes, returns, and reimbursements, introduce an additional layer of complexity. Finally, the critical task of verifying invoices and payments against bank statements further extends the reconciliation process, consuming valuable time and resources.

Amazon USA vs. India: Reconciliation Essentials

Global vs. Local: Distinguishing between Amazon USA (.com) and India (.in) is key for reconciliation. Amazon USA caters to a global audience with transactions in USD, while Amazon India focuses on the Indian market with transactions likely in INR.

Reconciliation Nuances: These differences influence how you approach reconciliation:

Amazon USA: Broader process due to global reach and potential for multiple currencies.

Amazon India: Localized focus with potential currency fluctuations and tax considerations.

Understanding these distinctions empowers businesses to tailor their reconciliation strategy for each Amazon marketplace.

Reconciliation Process

Reports required for reconciliation

1. Amazon Order Reports:

- All Order Report: Provides a comprehensive breakdown of all orders placed, including order details, customer information, and order status.

- MTR (Merchant Transfer Report): Details fees associated with each order, allowing you to verify fee accuracy and calculate net sales.

2. Amazon Payment Reports:

- Disbursement Report: Summarizes all payments received from Amazon for your sales, including transaction details and deposit amounts.

3. Amazon Return Reports:

- All Return Report: Tracks all returned orders, including details on returned items, reasons for return, and associated refunds.

- FBA Return Report: Specifically focuses on returns processed through Amazon’s Fulfillment by Amazon (FBA) service.

4. Amazon Reimbursement Report:

Details any reimbursements received from Amazon for damages, lost inventory, or other discrepancies.

5. SKU Master File:

This file contains vital product information for each Stock Keeping Unit (SKU) you sell on Amazon, including product details, pricing, and inventory levels.

Join successful businesses like our customers in optimizing your Myntra transactions with Cointab!

Payment Verification

1. Two-Level Order Report Summary:

- Level 1 (Order ID & SKU): Provides a granular view of your sales activity by grouping orders according to both Order ID and SKU (Stock Keeping Unit).

- Level 2 (Amazon Order Summary): Creates a concise summary focusing on unique Order IDs for each order.

2. Cross-Referencing Key Reports:

- Unique Order ID: Acts as the common thread to link the Amazon Order Summary with the following reports:

- Disbursement Report: Details all payments received from Amazon for your sales.

- MTR Report: Outlines fees associated with each order to calculate your net sales.

3. Accurate Payment Verification:

- We compare the expected net sales amount calculated from the MTR report with the actual payment amount reflected in the Disbursement report.

- This comprehensive cross-referencing ensures complete alignment and accuracy in your financial records.

4. Early Discrepancy Identification:

By performing this first-level verification, we identify any potential discrepancies in your Amazon payments early in the reconciliation process.

This allows for prompt investigation and resolution of any issues before they impact your finances.

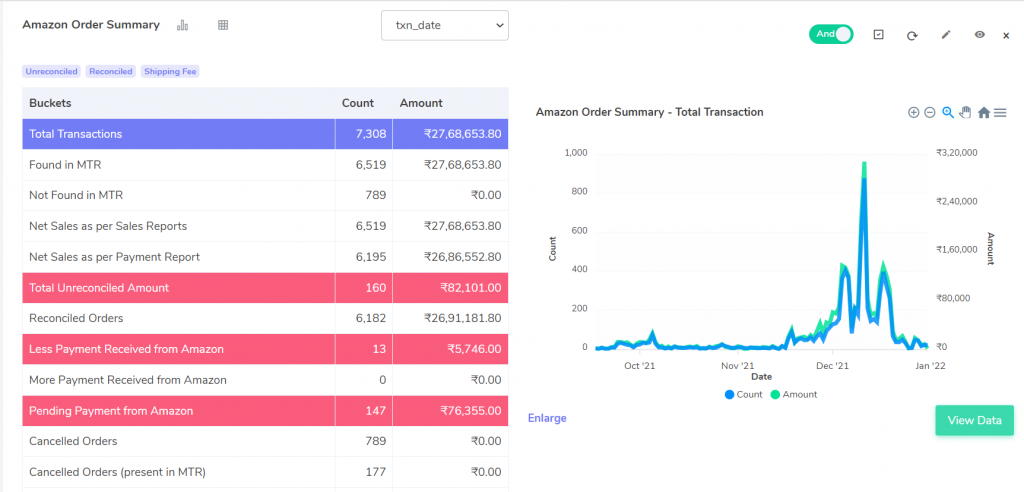

The result are displayed as follows

Total Unreconciled Amount

This section highlights the total sum of any discrepancies identified between your reports.

Reconciled Orders:

This category groups all transactions where the amounts in both the MTR (Merchant Transfer Report) and Disbursement reports perfectly match, indicating accurate settlements.

Less Payment Received from Amazon:

This section flags any orders where the Disbursement report reflects a lower payment than the expected net sales amount calculated in the MTR report. These discrepancies warrant further investigation to ensure you receive all due funds.

More Payment Received from Amazon:

This category showcases any orders where the Disbursement report shows a higher payment than the MTR report. While seemingly favorable, these discrepancies may indicate errors in Amazon’s calculations and require verification to avoid future complications.

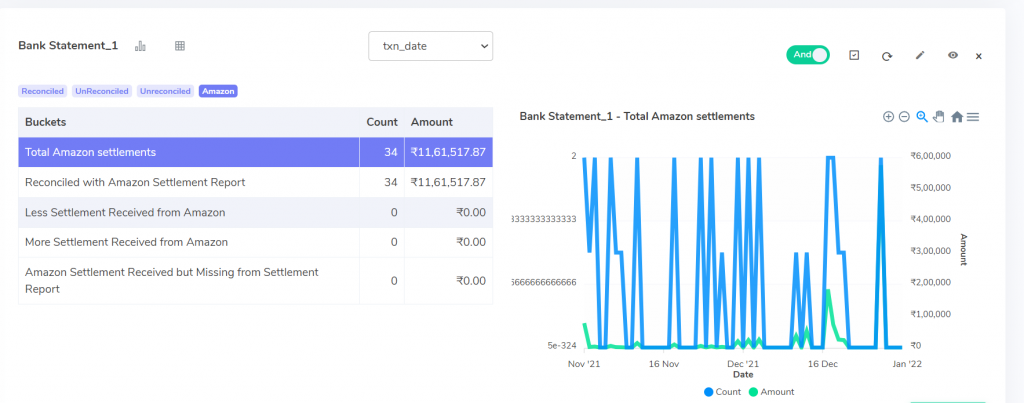

Bank Reconciliation

Our reconciliation process goes beyond verifying payments within Amazon reports. We ensure your bank account reflects accurate settlements with the following features:

Bank Statement Integration:

We link your settlement report to your bank statement for a comprehensive overview.

Regular Transaction Matching:

We verify the amounts between your Amazon settlement report and your bank statement, identifying any discrepancies early on.

Settlement Tracking:

Track the total settlement amounts deposited into your bank account over time, allowing you to monitor overall cash flow.

Proactive Discrepancy Identification: Our software actively identifies potential red flags:

- Unreceived Payments: We highlight any transactions with pending or missing payments in the settlement process, ensuring you receive all your due funds.

- Overpayments: Instances where the bank statement shows a higher amount than the settlement report are flagged for investigation, preventing potential future errors.

- Missing Transactions: Any transactions reflected in your bank statement but absent in the settlement report are documented, prompting further investigation into potential settlement issues.

Streamline your business with Cointab

Streamline your Amazon USA marketplace financial management with Cointab’s automated reconciliation software. Eliminate the tedious and error-prone manual process. Cointab’s software analyzes Amazon reports and bank statements, ensuring accurate settlements and flagging any discrepancies for your review. Furthermore, the user-friendly interface presents crystal-clear results categorized by “Reconciled Orders,” “Less Payment Received,” and “More Payment Received,” enabling swift identification of potential issues. Cointab empowers you to focus on strategic business growth while ensuring accurate financial records.

Book a demo today!