Effortless Amazon USA Marketplace Reconciliation With OMS

Effortless Amazon USA Marketplace Reconciliation With OMS

Scaling your business on the globally recognized Amazon USA marketplace is a thrilling accomplishment. However, managing the surge in transactions can quickly turn into a logistical nightmare. Inaccurate record-keeping practices amidst high-volume sales can lead to missed revenue opportunities and hinder profitability.

Cointab’s automated reconciliation software steps in as your trusted solution, streamlining Amazon USA marketplace with Order Management System (OMS) reconciliation. Our user-friendly software effortlessly retrieves and cleanses your Amazon data, automatically matching it with your internal records for a seamless reconciliation experience. This newfound financial clarity empowers you to make data-driven decisions and focus on strategic growth initiatives, rather than getting bogged down in manual tasks. With Cointab by your side, you can confidently navigate the complexities of the Amazon USA marketplace and unlock the full potential of your flourishing business.

Core Reports for Streamlined Reconciliation

Amazon Order Report:

This report acts as the foundation, providing a comprehensive record of all your Amazon orders. It details order details such as product information, quantities, and customer information.

Amazon Merchant Fulfilment by Amazon (MTR) Report:

Focused on fulfillment activities, the MTR report offers insights into the fees associated with Amazon’s fulfillment services like storage, picking, packing, and shipping.

Amazon Disbursement Report:

This report showcases all the financial transactions between Amazon and your seller account. It details the net amount deposited into your account after factoring in order proceeds, deductions for various fees, and any applicable refunds.

Amazon FBA Return Report:

Managing returns is an integral part of e-commerce. This report provides a clear picture of all returned items processed through Amazon’s FBA program, including the reason for the return and the corresponding deduction from your account.

Amazon Reimbursement Report:

In instances where product damage or loss occurs during fulfillment, Amazon may offer reimbursements to sellers. This report details all such reimbursements received from Amazon.

SKU Master:

This report acts as a reference point, containing essential information about each product you sell on Amazon. It specifies the Stock Keeping Unit (SKU) assigned by Amazon, product name, and potentially other relevant product details.

Bank Statement:

Integrating your bank statement into the reconciliation process ensures a holistic view of your finances. It allows for matching the net deposits received from Amazon with the actual amounts reflected in your bank account.

Order Management System (OMS) Reports:

Many sellers utilize third-party OMS platforms to manage their inventory, orders, and fulfillment processes. Cointab’s software seamlessly integrates with popular OMS solutions like Incred, Unicommerce, and EasyEcom, allowing for effortless data retrieval.

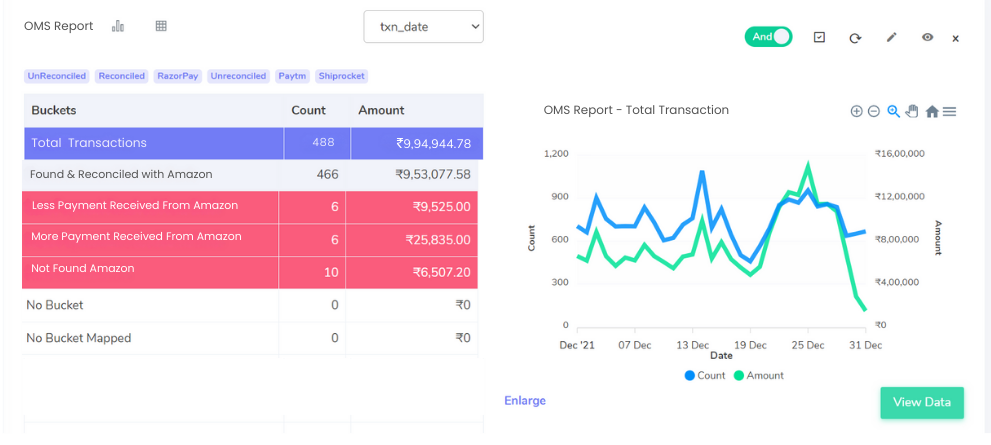

Matching Orders and Identifying Discrepancies

Cointab’s software meticulously compares every detail within your OMS with corresponding entries in the Amazon MTR report. This comprehensive analysis yields the following classifications:

Reconciled Orders:

Representing a perfect match, these orders showcase identical details (order information and amounts) in both the OMS and Amazon MTR reports. This signifies a seamless transaction process.

Discrepancies in Order Amounts:

Less Amount Recorded in OMS: Orders categorized here reflect a lower amount recorded in your OMS compared to the Amazon MTR report. This discrepancy warrants further investigation to identify potential underpayment from Amazon.

More Amounts Recorded in OMS: Conversely, these orders signify a higher amount recorded within your OMS compared to the Amazon MTR report. This might indicate overpayment to Amazon or potential discrepancies in order details.

Missing Orders

Missing in Amazon: These orders are present in your OMS but absent from the Amazon MTR report. This signifies missing data on Amazon’s end and requires further exploration to determine the order’s status.

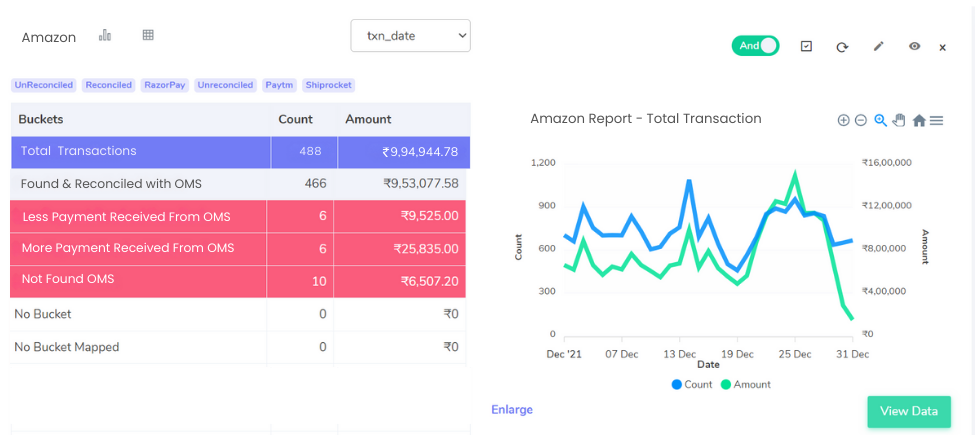

OMS vs. Amazon USA Report Reconciliation

Cointab’s software performs a two-way reconciliation, ensuring comprehensive financial oversight. Here’s a breakdown of the results from the Amazon USA report’s perspective:

Reconciled with Amazon: Similar to the previous section, this category signifies orders with identical details in both the Amazon MTR report and your OMS.

Discrepancies in Order Amounts:

Less Amount Recorded in Amazon: Orders falling under this category showcase a lower amount recorded in the Amazon MTR report compared to your OMS. This discrepancy might be due to errors in Amazon’s records or potential overcharges on your end.

More Amounts Recorded on Amazon: Conversely, these orders highlight instances where the Amazon MTR report reflects a higher amount compared to your OMS. This might indicate undercharges by Amazon or discrepancies in order details.

Missing in Amazon: These transactions are recorded in your OMS but absent from the Amazon MTR report, mirroring the previous scenario and requiring further investigation.

Join successful businesses like our customers in optimizing your Amazon transactions with Cointab!

Cointab revolutionizes Amazon USA marketplace reconciliation using OMS (Order Management System), empowering sellers to achieve financial clarity and unlock exponential growth. Our automated data loading eliminates the need for time-consuming manual entry and tedious format adjustments. Additionally, customizable rate and rule settings grant sellers the flexibility to tailor the reconciliation process to their unique business requirements. Cointab presents all reconciliation results on a comprehensive, universal dashboard, facilitating effortless analysis and data-driven decision-making. Furthermore, the ability to export results in any format, at any time, empowers sellers to seamlessly resolve disputes with Amazon USA and recover potential losses with exceptional efficiency.