In today’s digital world, every person in one or another way depends on online payments. When it comes to payment gateways, PhonePe has emerged as a frontrunner in the payment gateway space, offering a comprehensive suite of features for managing finances. From facilitating everyday purchases to mobile top-ups and investment options, PhonePe empowers users with a centralized financial hub.

Businesses have widely adopted PhonePe to cater to the growing preference for online payments which necessitates a per-transaction fee. For businesses processing a high volume of daily orders, tracking the associated fees and taxes on each individual transaction can become a significant burden. Manually reconciling these fees can lead to inefficiencies and potential errors, hindering operational efficiency.

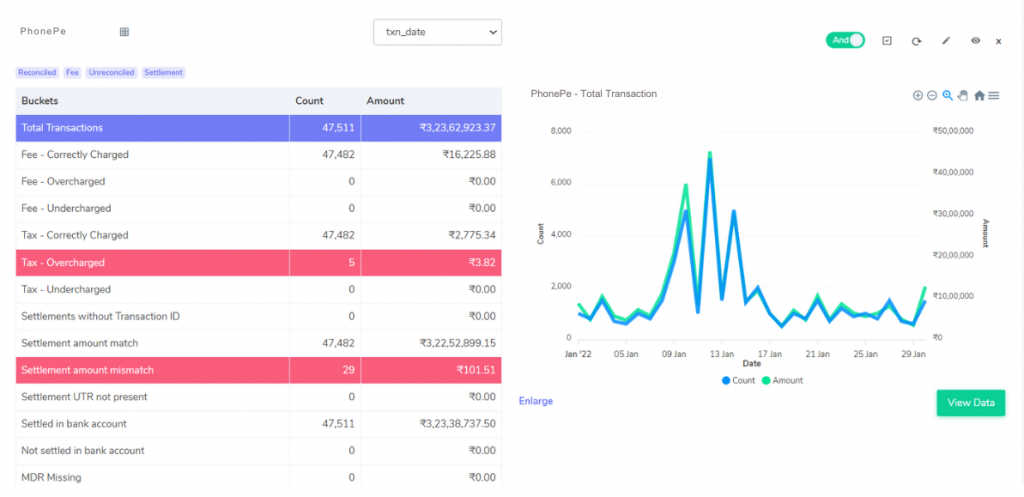

Cointab’s automated reconciliation software simplifies PhonePe fee and tax management. This innovative solution streamlines the process by verifying fees, taxes, and the final settlement amount for every transaction. Cointab then meticulously compares this information to your PhonePe report, highlighting any discrepancies that may require further investigation.

PhonePe Payment Gateway Charges Verification Reports Required

This report serves as a detailed transaction log, providing a clear picture of your financial activity with PhonePe.

PhonePay Report:

- Transaction Amount and Date: Get a clear understanding of the exact amount processed for each order, alongside the corresponding transaction date.

- Fee and Tax Breakdown: This report unveils the specific fees and taxes levied on each transaction, allowing for effortless verification against PhonePe’s established pricing structure.

- Payment Method Identification: The PhonePe Payment Report sheds light on the specific payment method used for each order, whether it’s UPI, credit card, debit card, net banking, or any other available option.

- Issuing Bank Information: The report provides crucial details regarding the issuing bank associated with each transaction.

PhonePe Rate Card:

This document outlines the fee and tax structure for PhonePe’s services.

- Fee & Tax Rates: Clearly defines the current fees and taxes applicable to various transactions.

- Validity Period: Specifies the dates within which these specific rates are in effect.

PhonePe Payment Gateway Charges Verification: Decoding the Results

Fee Analysis:

Correctly Charged Fees: These reflect a perfect match between PhonePe’s charged fees and the software’s calculated amounts.

Overcharged Fees: Orders under this category are charged more than the calculated fee. You may want to investigate these discrepancies for potential refunds.

Undercharged Fees: These transactions highlight instances where PhonePe has charged a lower fee than calculated. While seemingly beneficial, it could signal inconsistencies requiring clarification with PhonePe.

Tax Verification:

Correctly Charged Taxes: Orders displayed here match PhonePe’s charged taxes and the software’s calculated amounts, typically estimated at 18% GST on fees.

Overcharged Taxes: These transactions indicate that the tax charged is more tax than calculated. It’s advisable to investigate these discrepancies to potentially claim tax adjustments.

Undercharged Taxes: Orders under this category highlight instances where PhonePe has charged a lower tax than calculated. While seemingly beneficial, it’s crucial to understand the reason to avoid future tax liabilities.

Settlement Amount Breakdown:

Settlement Amount Match: These orders perfectly match the settlement amount calculated by the formula (Amount Collected – Fee – Tax) and the amount displayed in the report provided by PhonePe.

Settlement Amount Mismatch: Transactions displayed here indicate a discrepancy between the calculated settlement amount and the amount in the PhonePe report. This warrants further investigation to rectify potential errors.

Settlement UTR Status:

Settlement UTR not present: These transactions have missing settlement UTRs (Unique Transaction Reference) in the report.

Bank Settlement Status:

Settled in Bank Account: These transactions signify successful settlements reflected in both the PhonePe report and your bank statement, indicating receipt of funds.

Not Settled in Bank Account: Orders displayed here indicate transactions present in the PhonePe report but absent from your bank statement. This signifies outstanding payments from PhonePe that require follow-up.

In Short, Cointab reconciliation software isn’t just about throwing numbers but it also makes use of graphs and charts to make analyzing the transaction effortless. It keeps a keen eye out for any overcharged or undercharged fees or taxes and checks if the settlement amount matches or not. With everything tracked and clear as day, you can easily identify missing payments and ensure that everything is in order. With Cointab reconciliation software, you can trust that your financial records are meticulously reviewed, providing peace of mind and enabling informed decision-making for your business.

Step into the future of reconciliation. Fill out the form to request your demo now!