Purplle is rapidly establishing itself as a dominant force within the burgeoning Indian e-beauty market. Their app offers a highly personalized shopping experience, in-depth user personas, virtual try-on capabilities, and product recommendations powered by a combination of personality traits, search history, and purchase behavior. This unique approach positions Purplle as a prime platform for beauty brands seeking to reach a vast and engaged audience.

However, for merchants, capitalizing on Purplle’s popularity can be hindered by complexities in record-keeping and ensuring transaction accuracy. Cointab’s automated reconciliation technology offers a powerful solution, enabling sellers to efficiently record and analyse transactions, promptly identify discrepancies, and initiate swift corrective actions or disputes with Purplle. This translates to maximized revenue potential for brands by minimizing the risk of financial losses due to errors.

Effective Purplle reconciliation hinges on a comprehensive set of reports provided by the Purplle marketplace:

Purplle Order Report: This report serves as the foundation for reconciliation, offering a detailed record of all transaction orders between the seller and the marketplace. It encompasses vital information such as order IDs, product details, quantities purchased, and order values.

Purplle Sales Report: Building upon the order details, the Purplle Sales Report delves deeper into completed sales transactions. This report provides a comprehensive picture of all sales finalized through the Purplle platform, including details like final sales amounts, applicable taxes, and any discounts offered.

Purplle Return Report: Returns and cancellations are an inevitable aspect of e-commerce operations. The Purplle Return Report ensures transparency in this area by providing detailed information on every order that has been returned or cancelled.

Purplle Payment Report: The successful culmination of any sale hinges on timely and accurate payments. The Purplle Payment Report plays an important role in reconciliation by recording all payments made for each order. This report includes details like the amount paid, transaction fees incurred (if any), and a crucial UTR ID that facilitates bank reconciliation.

Reconciling payments on a high-volume platform like Limeroad can be a nightmare for sellers. With deliveries happening daily and payouts arriving a few days later, keeping track of everything manually becomes nearly impossible. This is where a payment reconciliation system like Cointab comes in. It acts as a lifesaver for sellers by automatically linking relevant reports (Sales, Payouts, Orders) and creating a comprehensive summary. This summary breaks down every order detail, including the item price, any associated fees, and the final payment received. The system then neatly totals everything up and presents the results in an easy-to-understand format, allowing sellers to quickly analyze their finances and identify any discrepancies.

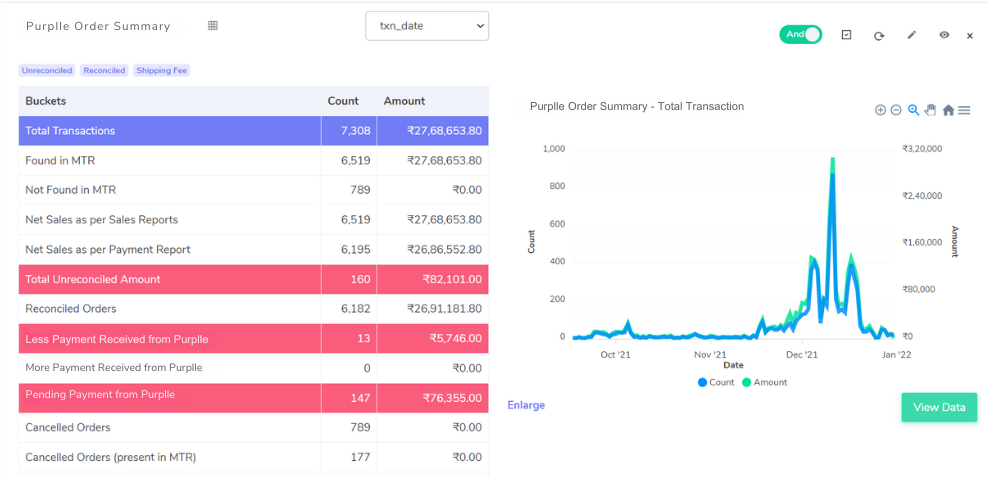

Reconciled with Order Summary: This category signifies transactions where the payment amount received by the seller perfectly aligns with the corresponding order value reflected in the Purplle Order Summary report.

More Amount Recorded in the Payment Report: These transactions indicate a discrepancy where the amount recorded in the Purplle Payment Report surpasses the amount detailed in the Order Summary. This could potentially be due to additional reimbursements or refunds issued by Purplle that weren’t initially reflected in the order value.

More Payment Received from Purplle (Less Amount Recorded in Order Summary): Conversely, this category highlights transactions where the total amount recorded in the payment report falls short compared to the amount reflected in the Order Summary report.

Not Paid Orders: This critical section flags all dispatched orders for which the seller has not yet received any payment from Purplle. Prompt follow-up with Purplle regarding these outstanding payments is essential to ensure timely revenue recognition.

Following the analysis of payment data within the Purplle ecosystem, the system delves into a crucial next step – bank reconciliation. This process verifies that every payment sent by Purplle is accurately reflected and credited to the seller’s bank account. Inconsistencies in this area, due to technical errors or human oversight, can lead to significant financial losses if left undetected.

Cointab’s system automates this critical process by meticulously linking the Purplle settlement report with the seller’s bank statement. This comprehensive analysis ensures:

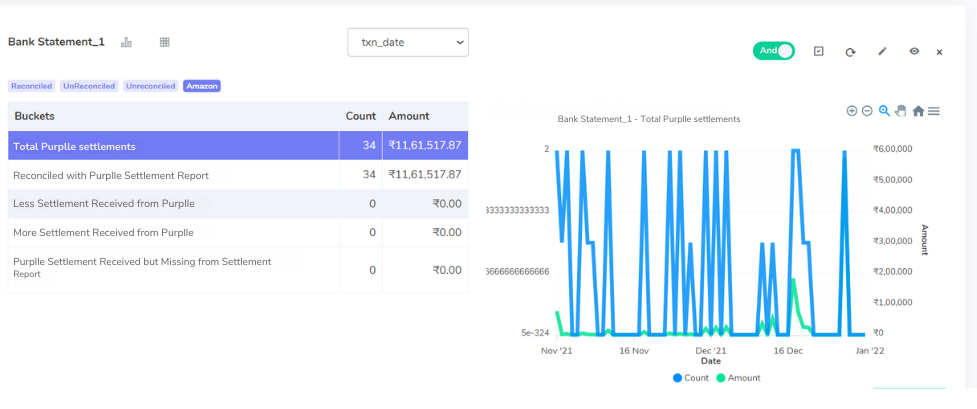

Total Transactions: This section displays the total number of transactions recorded within the seller’s bank statement for the reconciliation period.

Reconciled with Purplle Settlement Report: These transactions represent a perfect match between the bank statement entries and the corresponding settlement amounts guaranteed by Purplle.

Less Payment Received from Purplle: This category highlights discrepancies where the amount deposited in the seller’s bank account falls short of the promised settlement amount from Purplle. Investigating these discrepancies is essential to identify and rectify any discrepancies in payment processing.

More Payment Received from Purplle: Conversely, this section showcases transactions where the amount deposited in the bank exceeds the settlement sum initially promised by Purplle. This could potentially indicate an overpayment by Purplle, requiring further clarification or potential adjustments.

Missing In Purplle: These transactions represent entries within the seller’s bank statement where the corresponding Purplle payment amount was received but wasn’t reflected in the Purplle settlement report. Identifying these discrepancies ensures accurate revenue recognition and avoids potential financial oversights.

By systematically categorizing these results, Cointab’s reconciliation system empowers Purplle sellers to gain a crystal-clear understanding of any data mismatches between their internal systems, the Purplle platform, and their bank statements.

In today’s competitive e-commerce landscape, timely and accurate financial data is the cornerstone of informed decision-making. Inadequate reconciliation can lead to a multitude of challenges for Purplle sellers, including:

Unidentified Revenue Loss: Discrepancies can lead to missed payments or underpayments, impacting a seller’s profitability.

Inventory Management Issues: Inaccurate data can disrupt inventory management, leading to stockouts or overstocking, impacting customer satisfaction and operational efficiency.

Delayed Decision-Making: Inconsistent financial data hinders a seller’s ability to make data-driven decisions for business growth.

Failing to reconcile financial data thoroughly can significantly hinder a business’s ability to compete and adapt in today’s dynamic market. The increasingly complex business environment demands accurate verification processes to ensure swift and informed decision-making. Cointab’s reconciliation technology offers the most effective solution for achieving this critical objective. Contact Cointab today for a demo!