Building an online store can be quite a challenging task, especially for small companies. Many entrepreneurs prefer to outsource these kinds of things so that they can focus on what their core competency is. That’s where software like Shopify comes in. Shopify helps businesses build online stores and gives them the ability to make their business available online. Additionally, having a secured e-commerce portal is something that can be quite challenging and often time-consuming to set up. Whereas securing your store using Shopify may be a more secure solution than attempting to do it yourself. As you’ll need to invest considerable funds and need digital marketing/e-commerce expertise in order to have an adequately secure e-commerce website. Doing this may take months or years before it achieves optimum levels of security protection.

Shopify has become extremely popular because of the features it provides to its users. The features include the one-click buying, easy customization and customer service assistance to name a few. There’s an easy-to-use trial period for 14 days where all the features are available for use. After which you may subscribe and pick the pricing plan which works best for your business (Shopify offers three plans which are tailored to different types of businesses).

Different eCommerce companies that use Shopify to build their online store often use different payment gateways and COD vendors. Which can be difficult for finance departments who have to verify reports from all vendors within this ecosystem. This can lead to human errors or time wasted in checking if all the amounts paid or charged are accurate.

Problems Encountered in Website Reconciliation Process

- Multiple reports from different partners

- Interpreting the various reports

- Difficulty in sharing reports with the employees as there are too many reports

- Checking and keeping track of various excel sheets

- Having to repeat this complicated process every month

- Investing extra funds to acquire more staff to carry out this process

Taking into account all the problems faced in the website reconciliation process, companies need to a way to simplify this process. Hence companies can use Cointab’s software which can easily connect Shopify, any Order Management System, Payment Gateway, Cod vendors and the bank to one another, so as to create a comprehensive report of what has happened from every angle. It integrates all the entities to reconcile all payments in a way that is easy for anyone to read and understand, but also enables you to easily access the information that matters most.

Pros of using the Cointab Software for Website Reconciliation

- Linking all the reports from different vendors

- Verification of payments and orders

- Automated production of the final result

- Provides Technical Assistance

- Ease of sharing the report with the whole team

Reconciliation Process:

Scope / Entities

- Shopify

Customers will often go to the Shopify site to browse for their purchases. Customers add a product to their shopping cart and then they are redirected to the checkout where they can choose from either paying online instantly via credit or debit card or paying cash on delivery if it is available. Shopify also produces its report to keep a track of every transaction that happens.

- EasyEcom order management system

EasyEcom keeps a track of all the orders placed from the Shopify website, it also keeps a track of the payments made by the Payment Gateway partner and the COD partner.

Our software then helps reconcile EasyEcom’s Reports against the Payment Gateway partner and the COD partners report.

- Payment gateway

Payment gateway is a software that provides the service of allowing payments through debit card, credit card, net banking etc.

Our software reconciles the payment gateway report with the EasyEcom report and the bank statement. This is used to check the payments made by the payment gateway partner on the orders fulfilled.

- COD remittance

The other option that people use to pay is cash on delivery for which companies partner with a COD vendor who then later makes the payments received to the company’s bank account. The COD vendor makes the COD remittance report to keep track of the payments and orders placed.

Our software reconciles the COD remittance report with the EasyEcom Report and the bank statement to check if the payments are made rightly.

- Bank Statement

It is used to check if the required amount to be paid by the COD or Payment gateway partner actually recaches the company’s bank account.

Cointab’s software reconciles the bank account with company’s internal reports , EasyEcom report, Payment Gateway report and the COD remittance report to check if the amounts paid are right or if amount is left unsettled.

Reports Used For Reconciling:

- Shopify order report

This report keeps a record of all the orders placed on the Shopify website during a given period of time. It is used to reconcile against the EasyEcom order report.

- EasyEcom order report

This report keeps a record of all the orders placed on the Shopify website which are recorded by the EasyEcom order management system. It is used to reconcile all orders against the Shopify Order Report.

- EasyEcom Sales tax report

This is a tax report filled while dispatching each order.

- EasyEcom Return tax report

This is a tax report filled when received a product back (customer return / RTO)

- EasyEcom Cancellation tax report

It is a tax report filled for orders which were made and then cancelled.

- EasyEcom SKU master

It is a record of the number of products that are kept in stock and the respective product details.

- Payment gateway settlement report

This report is used to reconcile with the bank statement and the EasyEcom report

- Payment gateway rate card

This is the rate card that consists of the tax rates to be charged on every purchase made by customers through the payment gateway.

- COD remittance reports from courier partner

This report is a record of all the payments made by customers through the Cash on delivery method which the COD partner has to pay back to the company.

- Bank statements

This is used to check if payment gateway or COD partners have paid the promised amount to the company’s bank account.

Reconciliation Result:

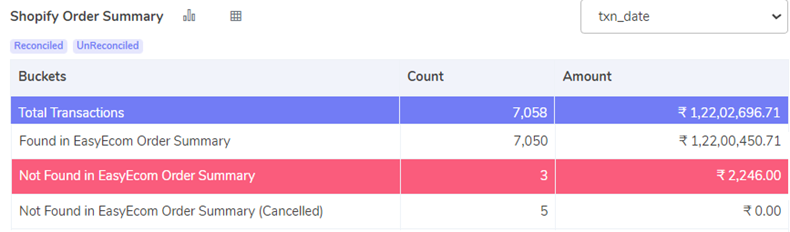

Shopify vs EasyEcom Reconciliation

Forward Reconciliation

Found in EasyEcom Order Summary-

Our software compares the Shopify report with the EasyEcom report and shows in this box the orders that match and are found in both the reports. This bucket shows those orders which are fulfilled and for which the company will receive payment.

Not Found in EasyEcom Order Summary-

Our software compares the EasyEcom report and the Shopify report and the orders that are not found in the EasyEcom report are displayed in this box. This is a list of orders that will not be completed because they were not included in the EasyEcom report. As a result, the organisation must carefully review these orders.

Not Found in EasyEcom Order Summary (Cancelled)-

The EasyEcom and Shopify reports are compared by our software, and orders that are not discovered in the EasyEcom report and were later cancelled are presented in this box. This indicates the orders that will not be completed since they are not registered in the EasyEcom report, but they are not a concern because they were subsequently cancelled.

Backward Reconciliation

Found in Shopify Order Summary-

Our software compares the EasyEcom report with the Shopify Report and shows in this box the orders that match and are found in both the reports. This feature shows those orders which are fulfilled and for which the company will receive payment.

Not Found in Shopify Order Summary-

These are the orders did not originate from the Shopify site, So the software assists in displaying that completed orders for which money will not be received. This is highlighted so that company can check these orders.

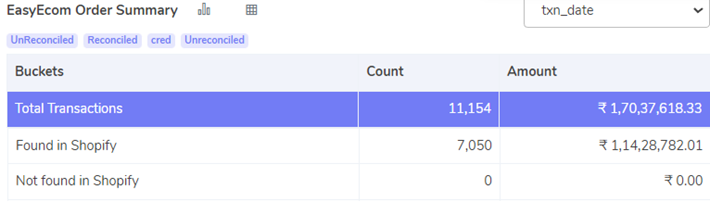

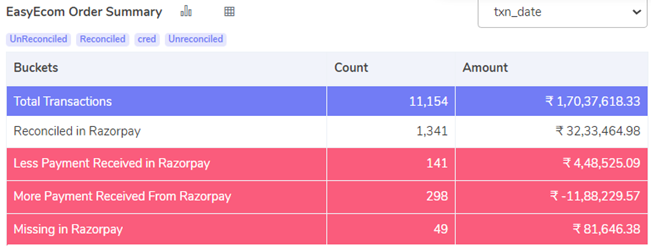

EasyEcom vs Payment Gateway (example: Razorpay)

Forward Reconciliation

Reconciled in PG:

Leverage our software’s capability to compare the EasyEcom report with the Payment Gateway report, unveiling identical transactions recorded by both. This invaluable feature assures your business that all payments routed through the payment gateway have been duly received.

Less Payment Received in PG:

Utilize Cointab’s software to compare the EasyEcom report with the Payment Gateway report, revealing transactions where payments remain outstanding. When the sales recorded in EasyEcom surpass those in the payment gateway report, it indicates a shortfall in received funds from the Payment Gateway partner.

More Payment Received from PG:

Identify discrepancies as the amount logged in EasyEcom falls short of that in the payment gateway report. Proactive awareness of such disparities enables prompt refunds and expedited customer support, enhancing client satisfaction.

Missing in Payment Gateway:

Illuminate orders absent from the payment gateway report, signifying fulfilled orders where payment remains outstanding. Thorough scrutiny of these transactions is imperative for financial diligence and client satisfaction.

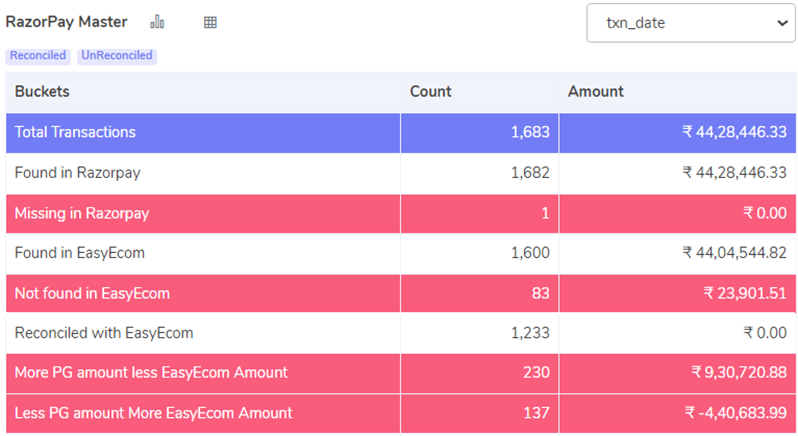

Backward Reconciliation:

Found in PG:

Discover prepaid orders awaiting payment from the payment gateway partner, providing clarity on pending transactions poised for completion.

Missing In PG:

Identify transactions absent from the payment gateway report through meticulous comparison with the EasyEcom report. This category highlights prepaid orders awaiting payment from the payment gateway partner, streamlining financial tracking processes.

Found in EasyEcom:

Uncover orders present in the EasyEcom report as compared to the Payment Gateway Report, indicating successful payments processed by the payment gateway partner for these prepaid orders.

Not Found In EasyEcom:

Detect orders absent from the EasyEcom report, yet slated for payment by the payment gateway partner. These prepaid orders, if overlooked, could lead to potential client dissatisfaction, emphasizing the importance of thorough review.

Reconciled with EasyEcom:

Ensure payment accuracy by identifying orders consistently reflected in both the Payment Gateway Report and the EasyEcom report, providing reassurance that payments have been correctly processed.

More PG amount Less EasyEcom amount:

Spotlight orders where the payment gateway partner has remitted excess payment compared to the EasyEcom report, optimizing financial oversight and facilitating timely adjustments.

Less PG amount More EasyEcom amount:

Identify orders where the payment gateway partner has disbursed insufficient payment relative to the EasyEcom report. This prompts diligent monitoring of pending amounts, ensuring comprehensive financial management.

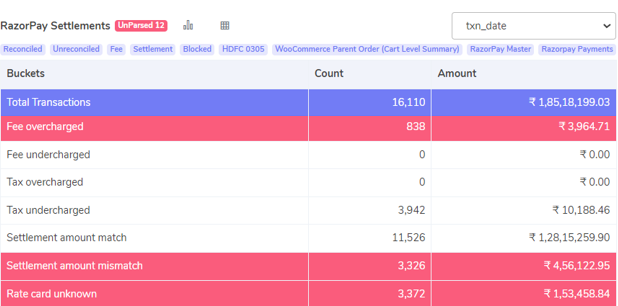

Payment Gateway Fee Verification

Fee Overcharged:

Our software meticulously identifies instances where the Payment Gateway partner has levied fees exceeding the predetermined amount outlined in the business agreement. This feature serves as a crucial alert system, ensuring companies are not subjected to unnecessary overcharges, thereby optimizing financial efficiency.

Fee Undercharged:

Effortlessly monitor transactions where the fee imposed by the Payment Gateway falls below the agreed-upon rate. This functionality empowers businesses to uphold contractual agreements, preventing any potential breaches.

Tax Overcharged:

Cointab’s advanced software flags transactions where the tax imposed by the Payment Gateway surpasses the contractual stipulation, cross-referencing with the established rate card. By quantifying the overcharged amount, this feature provides clarity and enables proactive management.

Tax Undercharged:

Identify transactions where the tax levied by the Payment Gateway falls short of the contractual obligation, calculated at 18% of the fee charged. Through meticulous review against the rate card, this feature ensures compliance and accurate taxation.

Settlement Amount Match:

Ensure financial precision with our system, which verifies that the settlement amount, derived from customer payments minus fees and taxes, aligns with the figures provided directly by the payment gateway, ensuring consistency and reliability.

Settlement Amount Mismatch:

Detect discrepancies in settlement amounts as our software compares calculated settlement figures with those provided by the payment gateway. This feature aids in identifying any inconsistencies or errors that may require further investigation or rectification.

Rate Card Unknown:

Highlight transactions where customers opt to utilize a consumer payment app not listed in the payment gateway partner’s rate card. This insight provides clarity on instances where rates may not be predefined, facilitating informed decision-making.

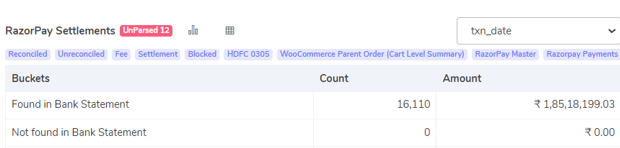

Payment Gateway vs Bank Statement

Forward Reconciliation

Found in Bank Statement:

Unlock insights into settled transactions as reflected in your bank statement from the payment gateway partner. This facilitates accurate tracking of the actual amounts received in your bank account for fulfilled orders, enhancing financial visibility.

Not Found in Bank Statement:

Illuminate pending transactions as our analysis reveals payments yet to be settled in your bank statement from the payment gateway partner. This aids in tracking the outstanding amounts awaiting receipt in your bank account for completed orders, ensuring comprehensive financial management.

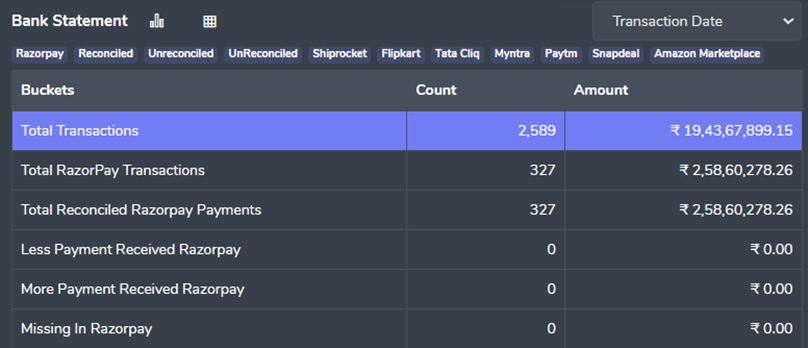

Backward Reconciliation:

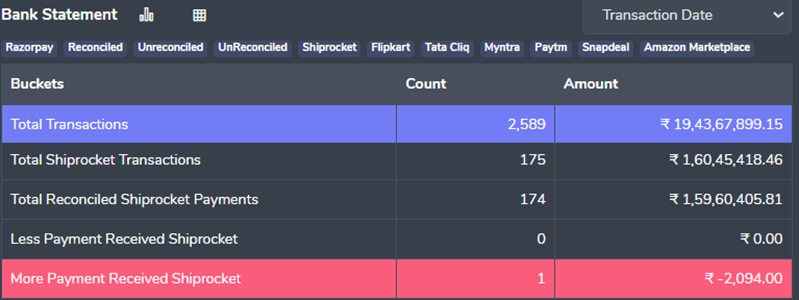

Total PG Transactions:

Gain comprehensive insights into customer transactions as we unveil the aggregate count of transactions processed through the payment gateway method, meticulously recorded in your bank statement.

Total Reconciled PG Payments:

Elevate financial transparency with this category, showcasing all purchase payments completed via the payment gateway that seamlessly reflect in your company’s bank account, ensuring reconciliation accuracy.

Less Payment Received PG:

Effortlessly identify discrepancies with our software, highlighting orders where received payments fall short of expectations from the Payment Gateway partner, streamlining resolution processes for optimal financial management.

More Payment Received PG:

Uncover payment anomalies with ease as our software detects instances where bank statement figures surpass those recorded by the payment gateway. This feature empowers swift action, facilitating potential refunds for overpaid amounts by the payment gateway.

Missing in Payment Gateway:

Navigate through transaction discrepancies seamlessly with our software, spotlighting orders absent from the payment gateway report after comparison with your bank statement, ensuring no oversight in your payment tracking process.

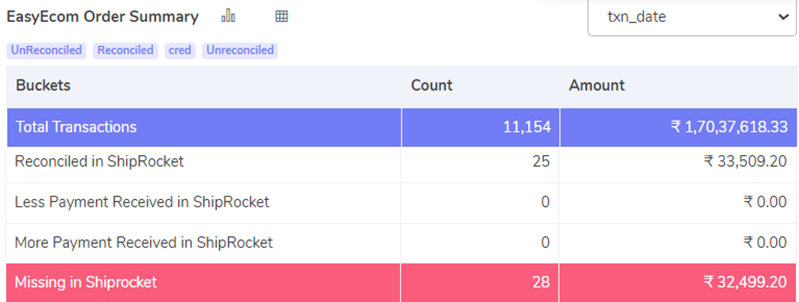

EasyEcom vs COD Remittance (Example: ShipRocket)

Forward Reconciliation

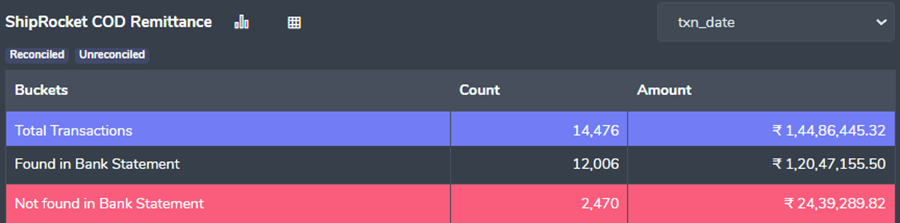

Reconciled with COD:

Experience seamless reconciliation as Cointab’s Software effortlessly aligns orders where the amounts recorded by EasyEcom and the COD remittance match perfectly, indicating successful payment reconciliation.

Less Payment Received in COD:

Identify discrepancies effortlessly with Cointab’s Software, pinpointing orders where the amount recorded in EasyEcom exceeds that recorded in the COD remittance. This highlights instances where payments received fall short of expectations, streamlining resolution processes.

More Payment Received in COD:

Gain clarity on payment discrepancies as our software detects instances where the amount recorded in EasyEcom falls short of the COD remittance. This feature empowers you to proactively address customer concerns by identifying instances of overpayment via COD.

Missing in COD:

Navigate through outstanding payments seamlessly with our software, spotlighting orders absent from the COD remittance report after comparing with the EasyEcom report. Uncover post-paid orders yet to be recorded in the COD remittance, streamlining your payment tracking process.

Backward Reconciliation:

Found in EasyEcom Order Summary:

Delve into comprehensive insights as we meticulously compare the COD Remittance report with EasyEcom Software, showcasing orders that align seamlessly in both reports. This synchronization indicates completed orders where payments have been successfully received from the COD partner.

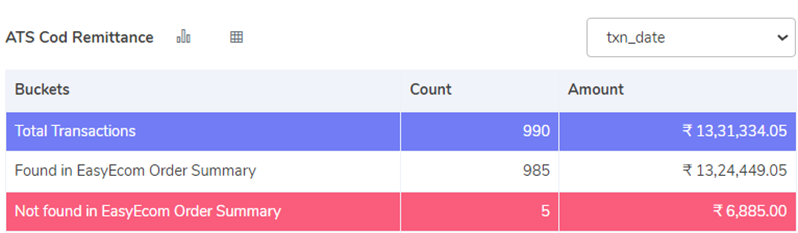

Not found in EasyEcom Order Summary:

Explore the realm of outstanding orders with our meticulous analysis. By juxtaposing the COD Remittance report against EasyEcom Software, we unveil orders absent from the EasyEcom system. Despite their absence, payments for these orders have been received from the COD partner, shedding light on potential discrepancies that require attention.

COD Remittance vs Bank Statement

Forward Reconciliation

Found in Bank Statement:

Discover insights into payment transactions as our software meticulously compares the COD remittance Report with your bank statement. Unveil instances where the COD vendor has efficiently disbursed payments for completed orders to your company.

Not Found in Bank Statement:

Delve into the realm of pending payments with our analysis. Identify prepaid completed orders where your company awaits payment from the COD partner. This crucial information sheds light on outstanding payments, aiding your company in managing pending orders efficiently.

Backward Reconciliation:

Total Number of Cash-on-Delivery (COD) Transactions:

This metric reflects the aggregate count of transactions detailed in the bank statement that originate from COD partners.

Total Reconciled COD Payments:

Cointab’s innovative software meticulously compares the bank statement with the COD remittance report, ensuring alignment of figures. This category showcases payments facilitated via COD partners that accurately match the funds received in the company’s bank account.

Deficit in Received COD Payments:

Through rigorous analysis, Cointab’s Software detects instances where the bank statement records a lower sum than reported by the COD partner. This indicates a shortfall in received payments vis-à-vis the expected amount into the company’s account.

Surplus in Received COD Payments:

Here, the discrepancy arises when the bank statement reflects a higher value than reported by the COD partner. This category illuminates instances where the COD partner remits funds exceeding the stipulated amount.

Reconciliation Insights:

The data presented above delineates the outcomes of the reconciliation process facilitated by Cointab’s software. By assimilating information from diverse sources including the EasyEcom report, payment gateway report, COD remittance report, internal company records, and bank statements, a comprehensive overview is generated. This user-friendly format empowers finance teams to monitor payment transactions, associated fees, and order placements, fostering a smoother reconciliation journey.