Effortless Snapdeal Marketplace Reconciliation with Cointab

Effortless Snapdeal Marketplace Reconciliation with Cointab

Managing millions of transactions across a vast marketplace like Snapdeal presents a challenge for sellers. With the potential for errors in payments and charges, reconciling your data with Snapdeal is crucial to ensure accurate financial records.

Traditional methods for analyzing vast, constantly changing data sets are time-consuming and inefficient.

Cointab streamlines the process, saving you valuable time on data handling. By automatically reconciling your data with Snapdeal, Cointab allows you to focus on analyzing discrepancies and resolving any errors efficiently.

Cointab’s automated reconciliation system empowers Snapdeal sellers with a multitude of benefits, saving them both time and money. By eliminating the need for manual data entry and analysis, sellers can free up valuable resources to focus on growing their business. Additionally, Cointab ensures enhanced accuracy and improved efficiency in the reconciliation process. Sellers gain a clear picture of their Snapdeal transactions with reliable financial records, and can focus on analyzing the reconciled data and resolving discrepancies more efficiently.

Snapdeal Reconciliation: A Streamlined Approach for Sellers

- Snapdeal Order Detail Report: Provides comprehensive details for all placed orders.

- Snapdeal Payment Settlement Report: Details payments made by Snapdeal to sellers, including UTR IDs for bank verification.

- Snapdeal Settlement Report: Offers a breakdown of all sales orders and corresponding amounts.

- Snapdeal Reversal Report: Lists refunded orders and associated payments.

Data Preparation & Configuration:

- System Integration: Configure your internal order management system to seamlessly integrate with Snapdeal’s settlement reports.

- Bank Statement Configuration: Set up your bank statement for credit verification.

- Data Cleaning & Structuring: Extract order IDs, clean data, and convert it into a structured format before reconciliation. Eliminate duplicates for accurate analysis.

- Data Summarization & Mapping: Summarize data by order and establish mappings between Snapdeal reports (internal order, settlement, reversal) and your bank statement.

Reconciled Transactions:

- Successful Sales: The internal report’s sale amount must match the settlement report.

- Refunds/Returns: Refunds should match the corresponding sales amount recorded in both internal and settlement reports.

- Canceled Orders: Neither sales nor refunds are recorded for canceled orders.

- Bank Statement Verification: The promised settlement amount should be found in the bank statement.

- Fee Verification: Ensure all applicable fees (commission, TCS, TDS) are levied correctly alongside the promised settlement amount.

Unreconciled Transactions:

- Sales Discrepancies: Investigate mismatches between internal and settlement report sales figures.

- Missing Entries: Identify missing credit entries in the internal report or missing sales entries in the settlement report.

- Bank Statement Discrepancies: Investigate any discrepancies between the expected settlement amount and the actual bank statement value.

- Incorrect Fee Charges: Verify that all fees are levied accurately as per your agreement with Snapdeal.

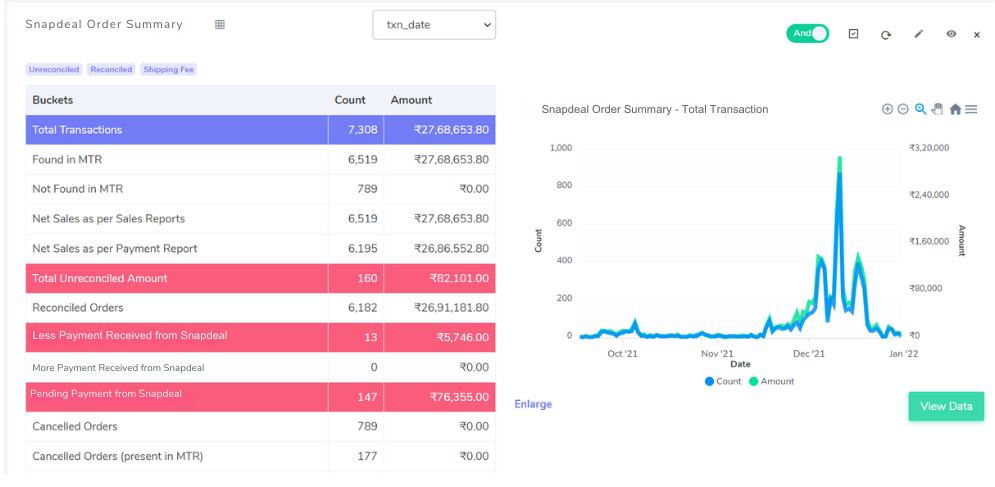

Results are as follows

Cointab simplifies Snapdeal reconciliation by presenting a clear and actionable breakdown of your transactions. Here’s what you’ll see:

- Net Sales from Order Detail Report: This reflects the total sales value as recorded in the Snapdeal order detail report.

- Net Sales from Settlement Report: This shows the total sales value as recorded in the Snapdeal settlement report.

- Reconciled Transactions: This indicates orders where the expected sale amount perfectly matches the received amount from Snapdeal.

- Total Unreconciled Amount: This highlights any discrepancies between the expected and received sales figures.

- Discrepancy Breakdown: Cointab further categorizes these discrepancies:

- Less Payment Received from Snapdeal: This signifies instances where you might have been underpaid by Snapdeal.

- More Payment Received from Snapdeal: This indicates situations where you might have received excess payment from Snapdeal.

6. Canceled Orders: This section details all canceled transactions, allowing you to easily identify and verify these orders.

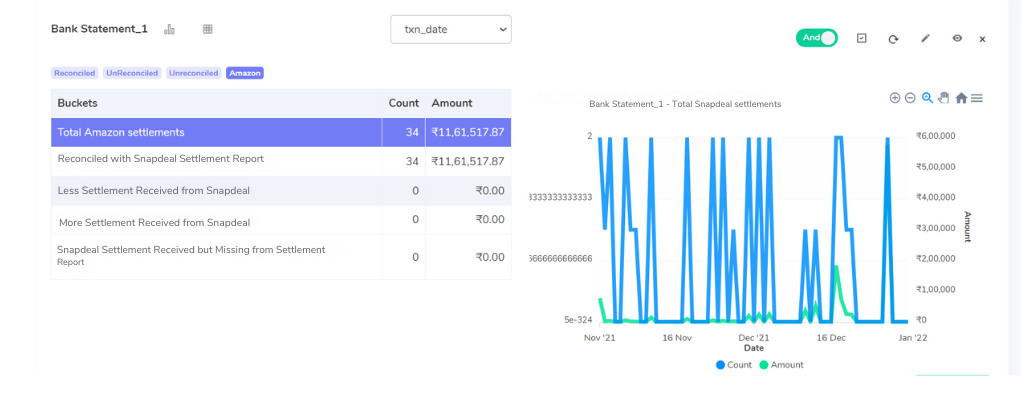

Bank Settlements Reconciliation

- Total Bank Transactions: This reflects the total number of transactions recorded in your bank statement for the reconciliation period.

- Total Snapdeal Settlements: This shows the total number of Snapdeal transactions identified in your bank statement.

- Reconciled Settlements: This indicates the number of transactions where the bank deposit perfectly matches the settlement amount promised by Snapdeal.

- Discrepancy Breakdown: Cointab highlights any discrepancies:

- Less Settlement Received from Snapdeal: This signifies instances where the bank deposit was lower than the promised settlement amount.

- More Settlement Received from Snapdeal: This indicates situations where the bank deposit exceeded the promised settlement amount.

5. Unreported Settlements: This section identifies transactions where the bank deposit matches a Snapdeal settlement, but the settlement is missing from the Snapdeal report.

Streamline Financial Management with Cointab

Bid farewell to manual data entry and eliminate the potential for errors associated with it. Cointab automates Snapdeal reconciliation and bank deposit verification, empowering you to focus on growing your business. Its advanced data analysis identifies inconsistencies across various sources, ensuring accurate financial records and informed decisions.

Get a demo with Cointab today and unlock streamlined financial management.