Streamline E-commerce Payments with Stripe:

Looking for a trusted payment gateway for your online store? Stripe, a leading processor for credit cards, debit cards, digital wallets, and bank transfers, is a popular choice for businesses of all sizes. Large e-commerce businesses leverage Stripe’s secure platform to facilitate recurring payments, giving their customers a familiar and trusted checkout experience.

<h1 style="font-size: 25px; cMinimize Reconciliation Headaches:

While Stripe simplifies payments, managing transaction fees and taxes can become a challenge, especially with high daily volumes. Even minor discrepancies can lead to losses. Automating reconciliation streamlines this process, saving your finance team valuable time and ensuring accuracy.

Cointab Reconciliation:

Effortless Accuracy:

Cointab Reconciliation automates the entire Stripe reconciliation process. It calculates fees, taxes, and settlements, then compares them to your invoices, highlighting both reconciled and unreconciled transactions for easy review.

Essential Reports for Seamless Verification:

Stripe Payment Gateway Charges Verification:

Gain a clear view of all Stripe fees and taxes associated with your transactions.

Stripe Payment Report:

This report provides a detailed breakdown of each transaction, including date, amount, tax, payment method, and issuing bank details.

Stripe Rate Card:

Stay informed about current fee and tax structures with easy access to your Stripe rate card information.

Result

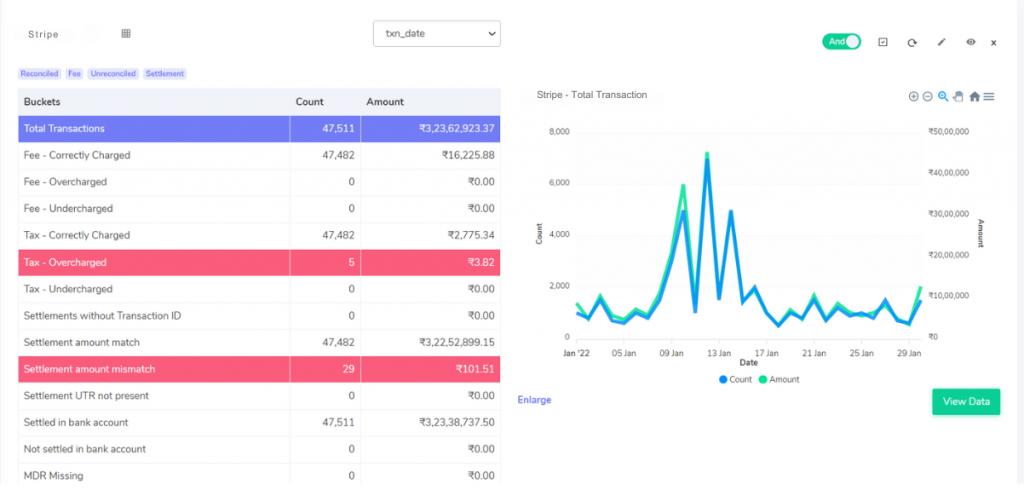

Effortless Analysis of Stripe Transactions:

Managing online payments can be a complex dance, especially with fluctuating fees and taxes. Cointab Reconciliation simplifies Stripe reconciliation by providing a crystal-clear breakdown of key metrics for each transaction. This empowers your finance team to analyze fees, taxes, settlement amounts, and more, all within a user-friendly interface. Imagine the time saved and the peace of mind gained by having complete visibility into your Stripe transactions!

Reconciliation Statuses – Deep Dive into Accuracy:

Fee Accuracy:

Fee Correctly Charged:

Transactions where the software-calculated fee matches the invoice amount, signifying perfect alignment.

Fee Overcharged:

Orders identified for potential overcharges compared to the invoice. Catch these discrepancies before they impact your bottom line!

Fee Undercharged:

Orders with potential undercharges based on the software’s fee calculation. Ensure you’re collecting the proper fees and avoid revenue leakage.

Tax Accuracy:

Tax Correctly Charged:

Transactions where the calculated tax (18% GST on fee) aligns with the invoice amount, reflecting accurate tax application.

Tax Overcharged:

Orders flagged for potential tax overcharges based on the software’s calculation. Identify and potentially recover any excess tax paid.

Tax Undercharged:

Orders with potential tax undercharges identified by the software. Ensure compliance and avoid future tax liabilities.

Settlement Amount:

Settlement Amount Match:

Transactions where the software-calculated settlement amount (amount collected – fee – tax) matches the Stripe report, confirming accurate settlements.

Settlement Amount Mismatch:

Orders requiring further investigation due to discrepancies between the calculated and reported settlement amounts. Don’t let discrepancies go unnoticed – investigate and rectify them promptly.

Settlement UTR not present:

Transactions lacking a UTR number (payment identification for bank transfers) may indicate incomplete settlements. Identify and address any potential settlement issues before they snowball.

Bank Settlement:

Settled in Bank Account:

Transactions where the order amount matches in both the bank statement and Stripe report, confirming successful settlement and a healthy cash flow.

Not Settled in Bank Account:

Orders requiring investigation due to mismatches between the bank statement and Stripe report, potentially indicating unsettled transactions. Resolve these discrepancies to ensure your funds are properly accounted for.

Actionable Insights for

Enhanced Financial Control:

Cointab Reconciliation goes beyond just reporting. The highlighted overcharged and undercharged transactions empower your finance team to:

Dispute Overcharges with Confidence:

Easily identify and dispute potential overcharges with Stripe using the reconciliation results. Back your claims with concrete data for a smoother resolution process.

Recover Funds Efficiently:

Reclaim any overpaid amounts from Stripe based on the software’s analysis. Improve your cash flow and prevent unnecessary losses.

Focus on Strategic Initiatives: Eliminate tedious manual reconciliation tasks and free up your finance team’s valuable time. Empower them to focus on strategic initiatives that drive business growth.

Effortless Accuracy, Maximum Control:

Cointab Reconciliation automates the entire process, eliminating manual effort and ensuring accuracy in your Stripe reconciliation. This empowers your finance team to gain valuable insights, improve financial control, maximize profits, and ultimately achieve long-term financial success. Don’t let manual reconciliation hold you back – embrace automation and unlock the full potential of your Stripe transactions!

Step into the future of reconciliation. Fill out the form to request your demo now!