Online platforms have become quite a great way to sell products and the biggest advantage that you have is the worldwide audience reach. Selling on e-commerce platforms like Tata Cliq opens doors to a global audience, empowering sellers to scale their businesses. As a prominent omni-channel marketplace, Tata Cliq provides a curated platform for sellers to connect with a vast customer base.

High-volume sellers on marketplaces like Tata Cliq face a significant challenge: ensuring accurate settlements amidst millions of transactions. Manually verifying payments after Tata Cliq’s fees can be a laborious and error-prone task, hindering operational efficiency and financial clarity. Cointab’s automated reconciliation software offers a comprehensive solution. By automating data entry, calculations, and verification of settlements received from Tata Cliq, Cointab empowers sellers to streamline their financial management processes. This not only saves valuable time and resources but also minimizes the risk of discrepancies and potential losses.

Reports needed for reconciliation

GST Report: This report acts as a detailed invoice, containing all relevant order information.

Sales Report: This report encompasses all your sales orders within a specified timeframe.

Payment Report: This report details all payouts made by Tata Cliq after deducting applicable fees.

By systematically comparing these reports, the reconciliation process matches each order with its corresponding payment, highlighting any discrepancies. This ensures sellers receive the correct amount for their sales and minimizes potential financial losses.

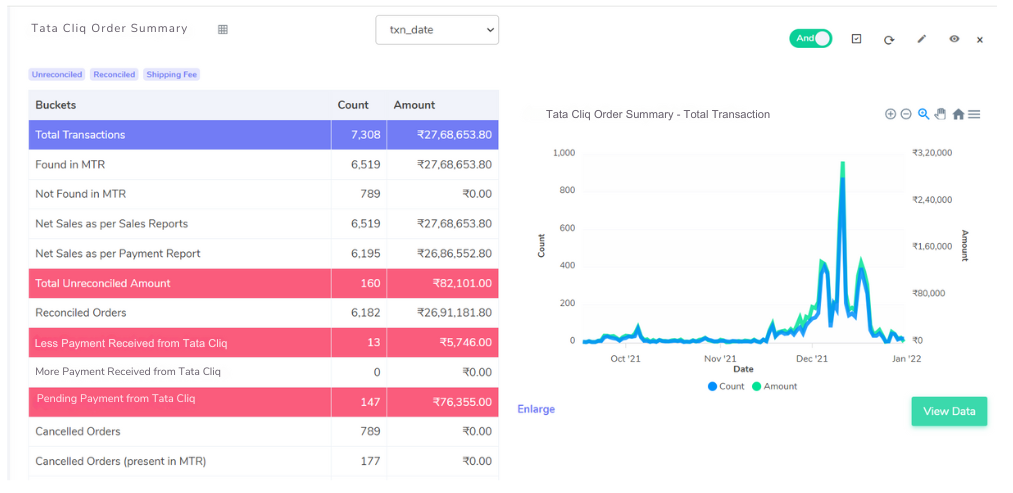

Tata Cliq Reconciliation Results

Sales:

Net Sales as per Sales Report: This section reflects the total sale amount recorded in your Tata Cliq order detail report. This represents the gross sales figure before any deductions.

Net Sales as per Settlement Report: Here, you’ll find the total sale amount as recorded in the Tata Cliq settlement report. This report typically reflects the final amount you’ll receive after accounting for deductions like commissions, shipping costs, and taxes.

Reconciliation Analysis:

Total Unreconciled Amount: This metric highlights the difference between the actual sale amount (as per your sales report) and the received amount (as per the settlement report). An ideal scenario would show a zero value here, indicating perfect reconciliation. Any discrepancies require further investigation.

Reconciled Transactions: These are transactions where the expected sale amount (from your sales report) matches the received sale amount (from the settlement report). This signifies a successful reconciliation for these specific transactions.

Less Payment Received from Tata Cliq: This section identifies transactions where the calculated sale amount (from your sales report) is greater than the received amount (from the settlement report). This could indicate potential underpayments from Tata Cliq and warrants further exploration.

More Payment Received from Tata Cliq: Conversely, this section showcases transactions where the calculated sale amount is less than the received amount. While seemingly favorable, it could be due to errors or overpayments from Tata Cliq and requires verification.

Unreported Sales:

Pending Payments: This category flags all transactions found in your GST report but missing from the settlement report. These are potential sales for which you haven’t received payment yet. It’s essential to investigate these discrepancies to ensure you receive the due amount.

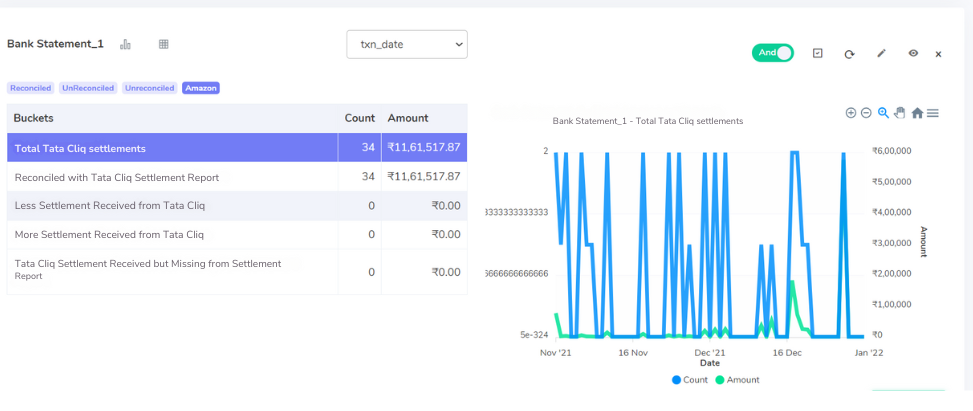

Bank Settlement Reconciliation

Total Transactions: View the total number of transactions recorded in your bank statement during the reconciliation period.

Total Tata Cliq Settlements: Identify the total number of settlements reflected in your bank deposits from Tata Cliq sales.

Reconciled Transactions: Easily pinpoint transactions where the deposited amount perfectly aligns with the settlement amount promised by Tata Cliq.

Underpayment Identification: Cointab promptly flags instances where the bank deposit falls below the promised settlement amount. This allows for swift investigation and recovery of any missing funds.

Overpayment Identification: Uncover situations where the bank deposit exceeds the settlement amount. You can then efficiently communicate with Tata Cliq to clarify any discrepancies.

Unreported Settlements: Catch instances where your bank statement shows deposits from Tata Cliq that are missing from the settlement report. Investigate these to ensure proper accounting and avoid potential future discrepancies.

Cointab empowers Tata Cliq sellers to achieve financial clarity, minimize discrepancies, and maximize their profitability through its robust bank reconciliation solution.