Monzo, a pioneering digital-only banking platform and marketplace, has revolutionized the financial landscape by offering a diverse range of products and services tailored to meet the needs of both personal and business customers. From current accounts providing seamless banking experiences to savings accounts offering competitive interest rates, and lending products facilitating access to funds for various ventures, Monzo has become a trusted partner for individuals and enterprises alike in managing their finances efficiently.

However, when businesses opt to integrate Monzo as their preferred payment gateway, it’s crucial to navigate the associated fees and taxes imposed on transactions with precision. These charges, deducted from customer payments, form a crucial aspect of financial operations. Nonetheless, amid this intricate process, discrepancies may occasionally surface, potentially leading to financial inaccuracies.

In such scenarios, Cointab reconciliation software emerges as a reliable ally, offering a streamlined approach to identifying and rectifying any discrepancies promptly and effectively. Leveraging sophisticated algorithms and intuitive interfaces, Cointab simplifies the reconciliation process, allowing businesses to effortlessly pinpoint any miscalculations and ensure the accuracy of their financial records.

To verify Monzo payment gateway charges comprehensively, businesses rely on essential reports provided by both Monzo and Cointab:

Monzo payment report:

This report offers detailed insights into the total transactions processed through Monzo’s payment gateway, along with information on the specific payment modes utilized. By analyzing this report, businesses can gain a comprehensive understanding of their transaction activity and associated costs.

Monzo Rate card:

The Monzo Rate card provides a breakdown of the fees, percentages, and payment modes applied to transactions. This invaluable resource empowers businesses to navigate the intricacies of transaction costs effectively, enabling them to make informed decisions regarding their financial operations.

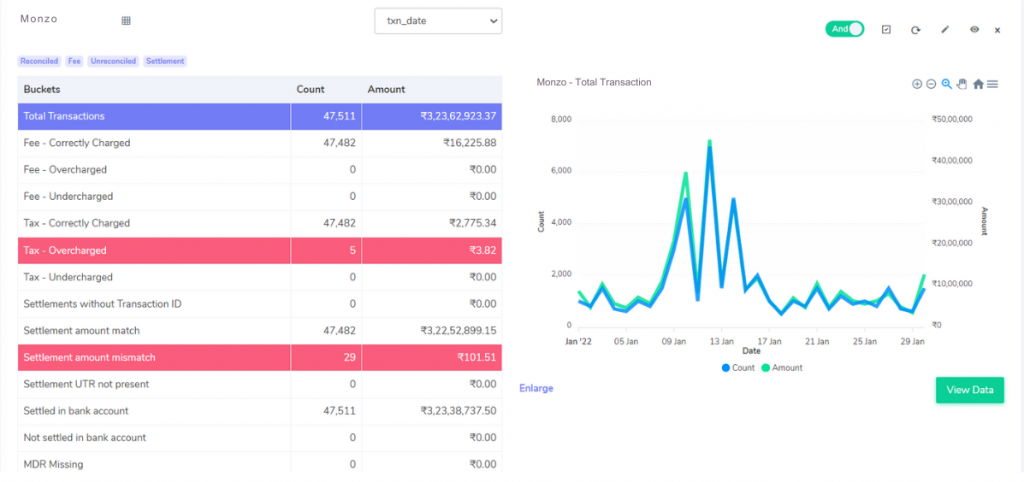

Results:

Navigating the intricacies of transaction fees and taxes is integral for businesses partnering with Monzo, a leading digital banking platform. Ensuring accurate charges is vital to maintain financial integrity and compliance. Here’s a breakdown of common scenarios businesses encounter when reconciling fees and taxes with Monzo:

Fee Correctly Charged:

In this scenario, the fees charged by Monzo align perfectly with the calculated amount based on the rate card. This indicates a seamless transaction process and accurate fee assessment.

Fee Overcharged:

Instances may arise where Monzo overcharges fees, surpassing the calculated amount outlined in the rate card. This discrepancy highlights the importance of vigilant monitoring and reconciliation to rectify any overcharges promptly.

Fee Undercharged:

Conversely, some transactions may reflect undercharged fees, falling short of the calculated amount specified in the rate card. Identifying and addressing these discrepancies ensures fair and transparent fee assessment.

Tax Correctly Charged:

Transactions where taxes match the calculated amount as per GST guidelines indicate adherence to regulatory standards and accurate tax assessment.

Tax Overcharged:

When taxes in the payment report exceed the calculated amount based on GST guidelines, it signifies a potential overcharge. Prompt identification and resolution are essential to rectify these discrepancies and ensure compliance.

Tax Undercharged:

Conversely, instances of tax undercharging occur when the tax amount recorded in the payment report is less than the calculated amount based on GST guidelines. Addressing these discrepancies is crucial to maintain regulatory compliance and financial accuracy.

Settlement UTR Not Present:

The absence of UTR (Unique Transaction Reference) in the payment report for certain transactions poses challenges in reconciliation. Prompt resolution is essential to ensure accurate transaction tracking and reporting.

Settlement Amount Match:

The settlement amount, calculated by deducting fees and taxes from the total amount, should align with the amount received in Monzo’s settlement report. A matching settlement amount indicates accurate transaction processing and reconciliation.

Settlement Amount Mismatch:

Discrepancies arise when the calculated settlement amount does not align with the amount received in Monzo’s settlement report. Identifying and rectifying these mismatches ensures financial accuracy and transparency.

Settled in Bank Account:

Transactions reflected in both settlement reports and bank statements indicate successful settlement in the bank account, affirming financial transparency and accuracy.

Not Settled in Bank Account:

Instances where UTR is present in the settlement report but absent from bank statements highlight discrepancies in transaction settlement. Addressing these discrepancies ensures accurate financial reporting and reconciliation.

Meticulous scrutiny of transaction fees and taxes is essential for businesses partnering with Monzo to ensure financial accuracy and regulatory compliance. Whether it’s rectifying overcharged or undercharged fees, addressing discrepancies in tax assessments, or reconciling settlement amounts, vigilance is key. Leveraging advanced reconciliation tools and software streamlines this process, enabling businesses to swiftly identify and rectify any discrepancies with Monzo transactions.

By embracing technology-driven solutions, businesses can not only enhance their financial operations but also elevate their overall efficiency and effectiveness. Moving forward, prioritizing accurate reconciliation practices will be pivotal in maintaining transparency and integrity in financial transactions, ultimately fostering long-term success and growth in today’s competitive landscape.

Step into the future of reconciliation. Fill out the form to request your demo now!