In today’s fast-paced digital landscape, businesses face a myriad of challenges when it comes to managing finances and facilitating transactions. As markets become increasingly globalized and consumer expectations evolve, the need for agile and efficient financial solutions has never been more critical. This is where Revolut steps in as a beacon of innovation and reliability. Renowned as a global leader in neo-banking and financial technology, Revolut offers a comprehensive suite of services tailored to meet the diverse needs of businesses worldwide.

At the heart of Revolut’s offerings lies its cutting-edge payment gateway, a solution designed to simplify and streamline the payment process for businesses of all sizes. Whether you’re a burgeoning startup seeking to establish a foothold in the market or an established enterprise looking to optimize your financial operations, Revolut’s payment gateway provides the tools and capabilities needed to succeed in today’s competitive landscape.

What sets Revolut apart from its competitors is its unwavering commitment to simplicity, transparency, and innovation. With a user-friendly interface and seamless setup process, businesses can quickly onboard onto Revolut’s platform and start reaping the benefits of its advanced features. Furthermore, Revolut’s payment gateway boasts competitive transaction fees, making it a cost-effective solution for businesses looking to maximize their bottom line.

In addition to its affordability and ease of use, Revolut’s payment gateway offers robust multi-currency support, catering to the diverse needs of businesses operating in a global marketplace. Whether you’re conducting transactions in pounds, euros, or dollars, Revolut ensures seamless currency conversion and facilitates frictionless cross-border payments.

Moreover, Revolut’s payment gateway is not just a transactional tool; it’s a strategic asset that empowers businesses to drive growth and innovation. By providing detailed insights into transaction activity and facilitating automated reconciliation processes, Revolut enables businesses to make informed decisions, optimize resource allocation, and enhance operational efficiency.

As businesses navigate the complexities of modern commerce, having a reliable financial partner is essential. With its unrivaled expertise, cutting-edge technology, and unwavering commitment to customer satisfaction, Revolut emerges as the ultimate partner for businesses seeking seamless payment solutions and efficient transaction reconciliation.

In the following sections, we’ll delve deeper into the key components of Revolut’s payment gateway reconciliation, explore how businesses can streamline operations and drive growth with Revolut, and discuss how Revolut empowers businesses to stay ahead of the curve in today’s rapidly evolving marketplace.

Key Components of Revolut’s Payment Gateway Reconciliation

Revolut Settlement Reports:

Gain comprehensive insights into placed orders and processed payments, empowering you with invaluable transaction data for informed decision-making.

Revolut Refund Reports:

Transparently track refunded amounts post-order cancellations, ensuring financial integrity and customer satisfaction.

Website Reports:

Access detailed records of orders placed through your business website, facilitating comprehensive transaction monitoring and analysis for enhanced performance.

ERP Reports:

Utilize internal reports to organize transaction information item-wise, optimizing resource allocation and driving operational efficiency.

Bank Statements:

Seamlessly integrate comprehensive bank statements, detailing transactions where payments are received via Revolut’s Payment Gateway, into your existing banking systems for streamlined financial management.

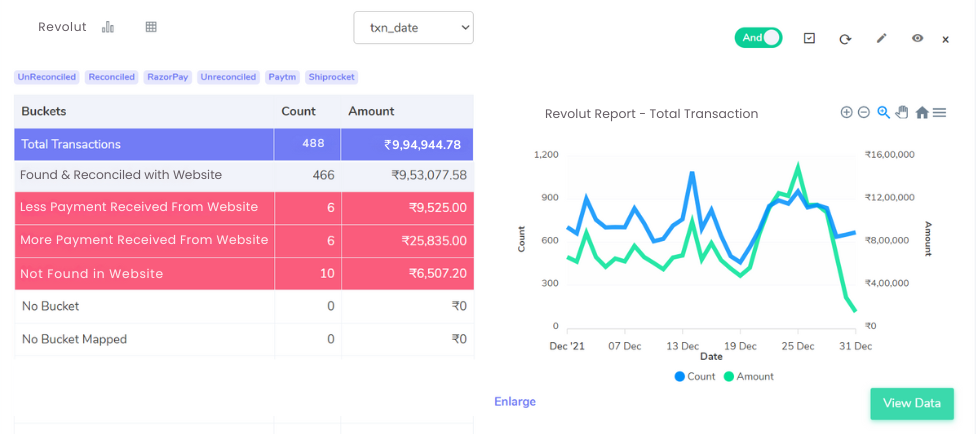

Revolut with website Reconciliation:

In the realm of financial management, precision is paramount. Our approach to reconciliation, facilitated through thorough analysis of Revolut settlement reports alongside website audits, ensures a comprehensive overview of transactional data.

Addressing Underreported Amounts:

When the website report falls short of accurately reflecting transactions, our scrutiny reveals disparities that demand rectification, safeguarding against potential losses and discrepancies.

Identifying Overreported Amounts:

Conversely, instances where website reports exceed Revolut settlements highlight potential overestimations. By pinpointing these discrepancies, we uphold integrity in financial reporting.

Tackling Missing Transactions:

Transactions present in Revolut settlements but absent in website reports signal a need for meticulous investigation. Our proactive stance ensures all transactions are accounted for, promoting accountability and transparency.

Streamlined Procedures for Financial Confidence:

By refining our reconciliation processes, we instill confidence in our financial operations, fostering trust with stakeholders and facilitating informed decision-making. With a focus on accuracy and transparency, we navigate financial landscapes with precision and integrity.

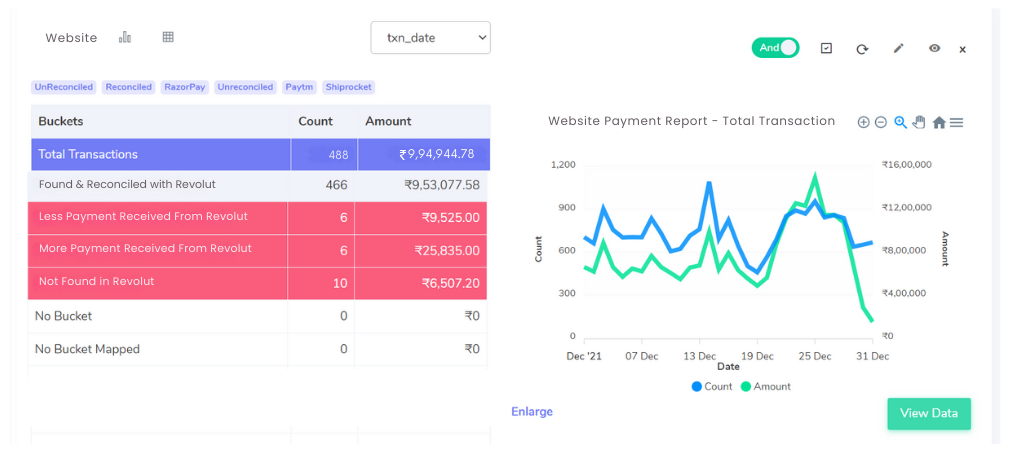

Website with Revolut Reconciliation:

Streamlined Reconciliation with Revolut Settlement Reports:

Transactions undergo meticulous reconciliation both on Revolut reports and website records.

Underreported Amounts on Revolut Reports:

Instances where Revolut reports show lesser amounts compared to website records are identified for scrutiny.

Overreported Amounts on Revolut Reports:

Conversely, discrepancies arise when Revolut reports indicate higher amounts than website records, warranting further investigation.

Cancelled Transactions:

Orders cancelled by customers are logged in website reports but omitted in Revolut settlement reports, highlighting the need for comprehensive reconciliation processes.

Optimizing reconciliation procedures ensures accurate financial data, fostering trust and transparency in transactions.

Streamline your Financial Reconciliation Now!

Request a Demo!

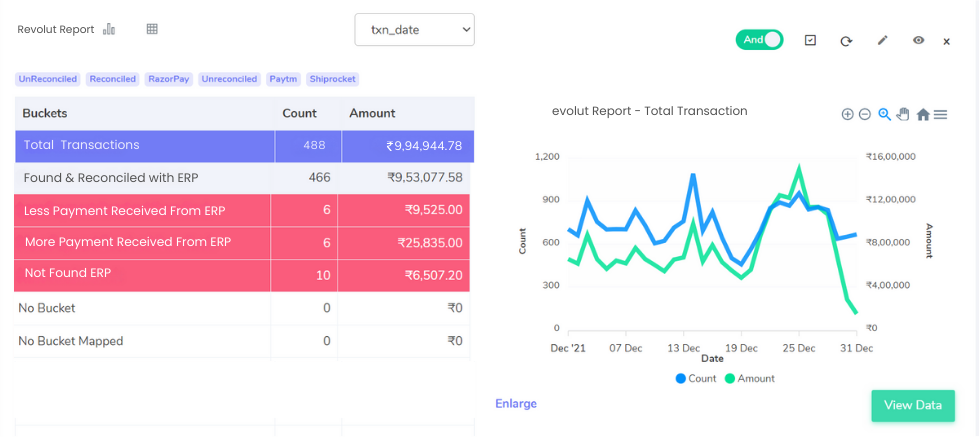

Revolut Reconiliation with ERP:

Efficient Reconciliation with ERP Reports:

Transactions are meticulously reconciled on both Revolut and ERP reports, ensuring accuracy and integrity.

Underreported Amounts on ERP Reports:

Instances where the ERP report shows lesser amounts compared to the Revolut report are identified and addressed.

Overreported Amounts on ERP Reports:

Conversely, discrepancies arise when the ERP report indicates higher amounts than the Revolut report, necessitating further investigation.

Transactions Missing from ERP Reports:

Transactions absent in ERP reports but present in Revolut reports require attention for comprehensive reconciliation.

Enhancing reconciliation processes ensures precise financial data, fostering trust and transparency in transactions for improved decision-making.

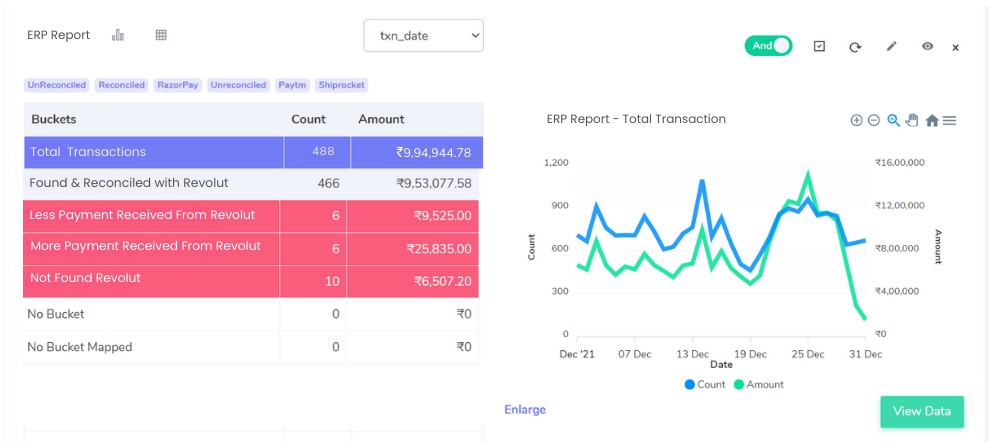

ERP Reports with Revolut Reconciliation:

Efficient Reconciliation with Revolut Settlement Reports:

Transactions undergo thorough reconciliation on both ERP and Revolut settlement reports, ensuring accuracy and consistency.

Underreported Amounts on Revolut Settlement Reports:

Instances where Revolut settlement reports show lesser amounts compared to ERP reports are identified and rectified.

Overreported Amounts on Revolut Settlement Reports:

Conversely, discrepancies occur when Revolut settlement reports indicate higher amounts than ERP reports, warranting detailed examination.

Transactions Missing from Settlement Reports:

Transactions present in ERP reports but absent in Revolut settlement reports necessitate careful review and alignment.

Cancelled Transactions:

Transactions recorded in Revolut settlement reports are flagged as canceled orders not reflected in ERP reports, highlighting the need for comprehensive reconciliation processes.

Streamlining reconciliation enhances financial transparency and reliability, bolstering informed decision-making.

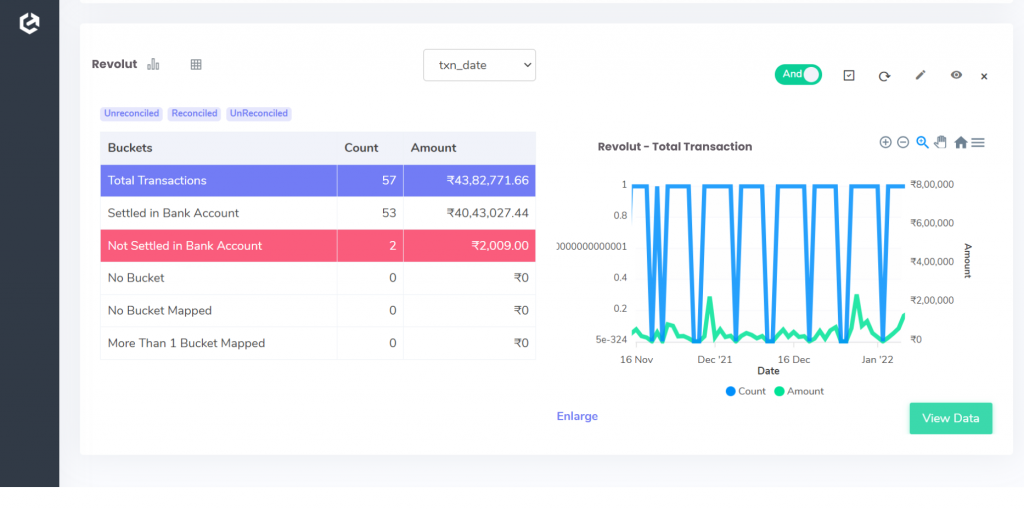

Revolut with Bank Reconciliation:

Enhanced Financial Oversight:

Transactions are visible on both bank statements and Revolut settlement reports, ensuring comprehensive tracking.

Unrecorded Transactions:

While transactions appear on Revolut settlement reports, they are absent from bank statements, necessitating attention for accurate financial reporting.

Ensuring Accuracy:

By cross-referencing bank statements with Revolut reports, discrepancies are identified and resolved promptly, maintaining financial integrity.

Transparent Reporting:

Transparent and thorough reconciliation processes bolster trust and confidence, facilitating informed decision-making and streamlined financial management.

Optimizing Financial Visibility:

Efficient reconciliation between bank statements and Revolut reports ensures a clear and accurate depiction of financial transactions, promoting accountability and efficiency.

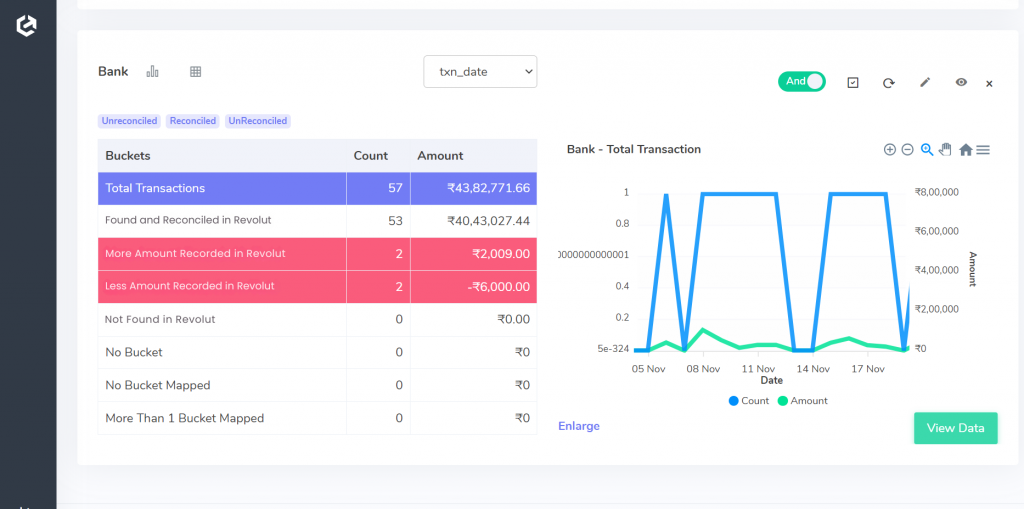

Bank reconciliation with Revolut:

Efficient Reconciliation:

Transactions are effortlessly found and reconciled on both bank statements and Revolut settlement reports, ensuring seamless financial tracking.

Increased Amounts on Revolut Reports:

Discrepancies emerge when Revolut settlement reports show higher amounts compared to bank statements, highlighting the need for meticulous review and adjustment.

Decreased Amounts on Revolut Reports:

Conversely, instances occur where amounts on Revolut settlement reports are lower than those on bank statements, necessitating thorough scrutiny for accurate financial reporting.

Missing Transactions on Revolut Reports:

Transactions present on bank statements but absent from Revolut settlement reports demand attention for comprehensive reconciliation and alignment.

The integration of automated software presents a transformative solution for businesses seeking to streamline their transaction reconciliation processes. By leveraging this technology, organizations can ensure the utmost accuracy in reconciling transactions across multiple platforms, including bank statements and Revolut settlement reports. The ability to effortlessly verify various financial documents, detect discrepancies, and make claims with Revolut if necessary, underscores the importance of embracing technological advancements in financial management.

Moreover, the adoption of automated software not only enhances reconciliation efficiency but also contributes to overall financial transparency and integrity. Businesses can confidently navigate complex financial landscapes, armed with the tools to swiftly identify and address discrepancies, thereby minimizing potential risks and ensuring compliance with regulatory standards. This proactive approach not only safeguards against financial discrepancies but also fosters trust among stakeholders, reinforcing the organization’s reputation for reliability and accountability.

Ultimately, the implementation of automated reconciliation software represents a strategic investment in optimizing financial processes and bolstering operational effectiveness. By embracing innovation and harnessing the power of technology, businesses can streamline their reconciliation workflows, mitigate risks, and drive sustainable growth in an increasingly competitive landscape. With automated solutions at their disposal, organizations can confidently navigate the complexities of financial management, positioning themselves for long-term success and prosperity.