Trust Payments empowers merchants with a seamless and customizable online payment experience. It integrates seamlessly with your existing systems, offering a variety of payment options for your customers, including debit cards, credit cards, UPI, and more. While the Trust Payments module itself is free, there are associated fees for using their services. These fees can be substantial, and with high transaction volumes, manual reconciliation becomes a time-consuming and error-prone process for your finance department.

Verifying the accuracy of Trust Payments charges can be a lengthy ordeal if done manually. Imagine sifting through mountains of data, meticulously comparing fees against rate cards, and ensuring proper tax calculations for each transaction. This not only consumes valuable staff time but also increases the risk of human error. Automated reconciliation software streamlines this process, saving you valuable time and financial resources. Cointab Reconciliation software automates transaction verification, ensuring accuracy and highlighting discrepancies in minutes. It identifies instances where you’ve been overcharged or undercharged by Trust Payments, allowing you to recover lost funds or avoid future overpayments.

Understanding the Importance of Reconciliation:

Reconciliation is the process of comparing two sets of financial data to ensure they match. In the context of Trust Payments, reconciliation involves verifying that the fees and taxes you’ve been charged align with the agreed-upon rates and applicable tax regulations.

Here’s why reconciliation is crucial for your business:

Prevents Overcharges:

Trust Payments fees can be complex, with different rates for various payment methods and transaction types. Manual verification can easily miss discrepancies, leading to overpayments on your end. Cointab software meticulously compares fees against the rate card, flagging any instances of overcharging.

Identifies Undercharges:

While undercharges may seem like a good thing initially, they can indicate billing errors by Trust Payments. These errors may be corrected later, resulting in unexpected adjustments or additional fees. Cointab identifies undercharges, allowing you to proactively address the issue with Trust Payments to ensure accurate future billing.

Ensures Proper Tax Calculations:

Tax regulations can be intricate, and even minor errors in tax calculations can lead to penalties or additional tax liabilities. Cointab software verifies that the tax amounts charged by Trust Payments comply with your region’s GST (Goods and Services Tax) guidelines.

Improves Financial Reporting Accuracy:

Accurate reconciliation ensures that your financial records reflect the true cost of processing payments through Trust Payments. This empowers you to make informed business decisions regarding your payment processing strategy.

Streamlines Dispute Resolution:

Should discrepancies arise between your records and Trust Payments’ reports, having a comprehensive reconciliation trail simplifies the dispute resolution process. Cointab provides detailed reports that document all transactions and highlight any inconsistencies.

Essential Reports for Trust Payments Charge Verification:

To ensure accurate reconciliation of Trust Payments charges, you’ll need access to the following reports:

Trust Payments Payment Report:

This report details all transactions processed, categorized by payment method (debit card, credit card, UPI, etc.). It should include the total transaction amount for each payment.

Trust Payments Rate Card:

The rate card outlines the fees and percentages charged for each supported payment method. This document serves as the benchmark for verifying the accuracy of the fees levied by Trust Payments.

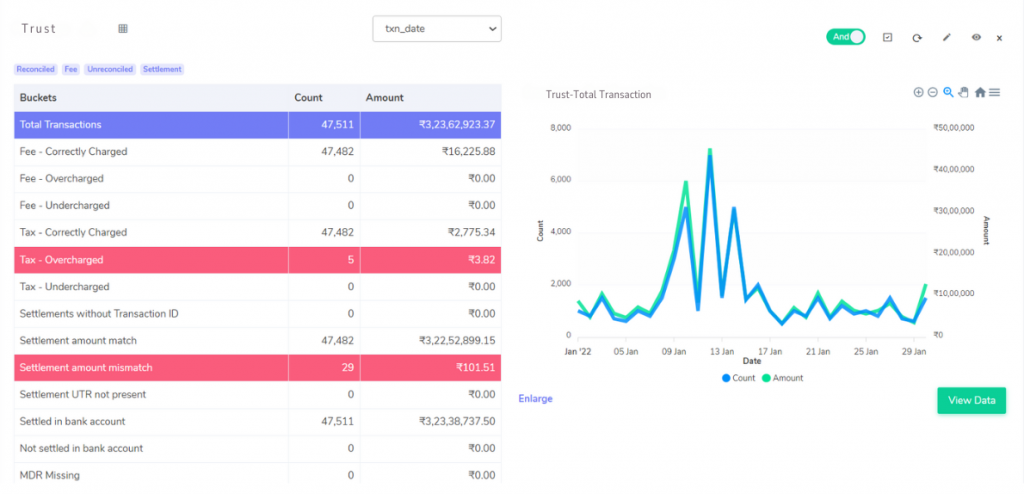

RESULTS

Reconciliation Process Breakdown: A Deep Dive

Cointab Reconciliation software automates the process of comparing your Trust Payments data with the rate card and tax regulations. Here’s a closer look at the key aspects of the reconciliation process:

Fees Correctly Charged:

Transactions where the fees levied by Trust Payments precisely match the amount calculated using the rate card. Cointab verifies these transactions to ensure they are processed accurately.

Fees Overcharged:

Transactions where Trust Payments charged more than the amount calculated based on the rate card. Cointab Reconciliation software will pinpoint these discrepancies, allowing you to claim a refund for the overcharged amount. The software provides detailed information about the transaction, including the specific fee that was overcharged, making it easy to build a case for a refund.

Fees Undercharged:

Transactions where Trust Payments charged less than the rate card dictates. While this may seem favorable on the surface, it can lead to future billing adjustments by Trust Payments. Cointab identifies these discrepancies, enabling you to proactively address the issue with Trust Payments to ensure accurate future billing.

Tax Correctly Charged:

Transactions where the tax recorded in the Trust Payments report aligns with the amount calculated based on your region’s GST (Goods and Services Tax) guidelines. Cointab verifies the tax calculations to ensure compliance with regulations.

Tax Overcharged:

Transactions where the tax amount in the Trust Payments report exceeds the calculated GST amount. Cointab can identify these discrepancies, enabling you to claim a tax credit for the overcharged amount. The software provides the necessary documentation to simplify the tax credit claim process.

Tax Undercharged:

Transactions where the tax amount in the Trust Payments report falls short of the calculated GST amount. This can result in penalties or additional tax liabilities later. Cointab identifies these discrepancies, allowing you to proactively contact Trust Payments to rectify the issue and avoid future tax burdens.

Settlement UTR Not Present:

Transactions missing the Unique Transaction Reference (UTR) number in the Trust Payments report. The UTR is crucial for tracking settlements and potential discrepancies. Cointab flags transactions lacking a UTR, prompting you to investigate the missing information with Trust Payments.

Settlement Amount Match:

Transactions where the settlement amount (total amount minus fees and taxes) accurately reflects the amount stated in the Trust Payments report. Cointab verifies these transactions to ensure they are processed correctly.

Settlement Amount Mismatch:

Transactions where the calculated settlement amount (total amount minus fees and taxes) differs from the amount in the Trust Payments report. Cointab will flag these discrepancies for further investigation. The software provides detailed information about the mismatch, allowing you to identify the source of the error and work with Trust Payments to resolve it.

Settled in Bank Account:

Transactions where the settlement amount is reflected in both the UTR report and your bank statement. Cointab verifies these transactions to ensure they are settled successfully.

Not Settled in Bank Account:

Transactions where the settlement amount appears in the UTR report but is absent from your bank statement. This could indicate a payment processing issue that requires further investigation. Cointab identifies these discrepancies, allowing you to promptly address the issue with Trust Payments to ensure timely settlement of funds.

Cointab Reconciliation Software: Your Gateway to Automated Efficiency

Cointab Reconciliation software streamlines the verification process by allowing you to upload data in your preferred format, including API, SFTP, and email. It empowers you to design a custom workflow tailored to your specific needs. This flexibility ensures seamless integration with your existing accounting system. Once the reconciliation process is complete, Cointab presents a comprehensive 360-degree view of the results, highlighting any discrepancies for further action. Reports are generated in a clear and concise format, facilitating easy analysis and allowing you to identify trends or recurring issues.

.

Embrace the Future of Reconciliation: Invest in Automation:

Manual reconciliation is a tedious and error-prone process that consumes valuable staff time and resources. In today’s fast-paced business environment, automated reconciliation software is no longer a luxury, but a necessity. Cointab

Reconciliation software offers a range of benefits:

Increased Efficiency:

Automates the reconciliation process, freeing up your staff to focus on more strategic tasks.

Enhanced Accuracy:

Eliminates human error, ensuring the accuracy of your financial records.

Improved Visibility:

Provides a comprehensive view of your Trust Payments charges, empowering you to identify trends and optimize your payment processing costs.

Faster Dispute Resolution:

Streamlines the process of identifying and resolving discrepancies with Trust Payments.

Reduced Operational Costs:

Saves time and resources associated with manual reconciliation.

By leveraging Cointab Reconciliation software, you can achieve a state of effortless reconciliation for your Trust Payments charges. Experience the difference and gain complete control over your payment processing costs today!