SecurePay is a specialist in online payment services, offering e-commerce payment solutions to businesses across the globe. With a track record of delivering online payment solutions to over 40,000 Australian businesses and organizations, it stands as a reliable choice for conducting online commerce efficiently, swiftly, and with cost-effectiveness at its core.

SecurePay as a payment gateway imposes certain fees in order to avail of its services. Occasionally there might be instances where your business might have been overcharged. It is crucial to keep track of the amount that is being overcharged, in order to safeguard your business in the long term.

You can put your concerns about reconciliation to rest with the help of Cointab Reconciliation software. This powerful tool effortlessly handles data reconciliation in any format and can manage large volumes of data without a hitch. The process of reconciling transactions has never been easier – simply upload your data and customize it to suit your specific business requirements. For a more comprehensive understanding of the reconciliation process, please refer to the details below.

Reports required for SecurePay Payment Gateway charges verification:

SecurePay Payment Report:

This report consists of the total transactions and from which payment mode (debit card, credit card, UPI, etc.) the transactions are made.

SecurePay rate card:

The rate card consists of the payment mode which has been used and the fees, and percentage that are been charged

RESULTS:

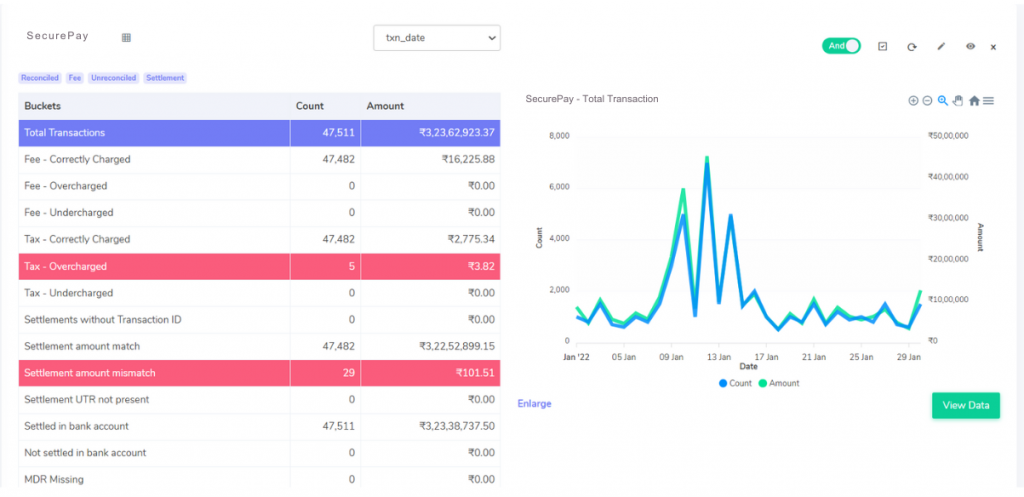

Fees correctly charged:

For these transactions, the fees charged by SecurePay are correctly matched with the amount calculated using the Rate card.

Fees overcharged:

Here the fees charged by SecurePay are seen to be more than the amount calculated using the rate card.

Fees undercharged:

The fees charged by SecurePay are seen to be less than compared to the amount calculated using the rate card.

Tax correctly charged:

The tax recorded in the payment report matches the tax calculated as per the GST guidelines.

Tax overcharged:

Tax recorded in the payment report is seen to be more compared to the amount calculated using GST guidelines.

Tax undercharged:

Tax recorded in the payment reports are seen to be less than the amount calculated using GST guidelines.

Settlement UTR is not present:

UTR is not present in the payment report for these transactions.

Settlement amount match:

The amount calculated after deducting the fees and taxes is the settlement amount and for these transactions, the amount matches in the SecurePay report.

(Settlement amount= Total amount- Fees – taxes)

Settlement amount Mismatch:

After the fees and taxes are deducted from the total amount, the settlement amount doesn’t match the amount in the SecurePay report. Hence, it is known to be an amount mismatch.

Settled in bank account:

The amount is present on the Settlement report as well as on the Bank statement.

Not settled in bank account:

The amount is present on the Settlement reports but not on the Bank statements.

Cointab reconciliation software offers a solution for manual reconciliation by offering automated software. Verification of transactions can be carried out by following some simple steps which include uploading data in your preferred format and customizing the workflow. Once the reconciliation process is completed, the miscalculations in the transactions are highlighted in red for easy identification. Start your automated reconciliation journey today with Cointab Reconciliation software and witness the remarkable journey ahead.

Step into the future of reconciliation. Fill out the form to request your demo now!