Do you accept online payments through PayPal?

Millions of businesses trust PayPal for its secure and user-friendly platform. But managing a high volume of transactions can be a challenge. Manually reconciling PayPal reports with your internal records, ERP system, and bank statements is time-consuming and prone to errors.

Introducing Cointab Reconciliation – Effortless PayPal Reconciliation

Cointab simplifies the entire process by automating data loading, report linking, processing, and export. Our software seamlessly reconciles your:

PayPal Settlement Report:

All your processed payments

PayPal Return Report:

Details of any returned orders (RTOs)

Website Report:

Order details from your website

ERP Report:

Transactions recorded in your ERP system

Bank Statement:

Payments received from PayPal

Benefits of Cointab Reconciliation:

Save Time:

Automate the reconciliation process, freeing your finance team for more strategic tasks.

Improved Accuracy:

Eliminate manual errors and ensure all payments are accounted for.

Identify Discrepancies:

Easily pinpoint mismatched amounts and missing payments.

Streamlined Workflow:

Gain a clear overview of your finances with a comprehensive reconciliation report.

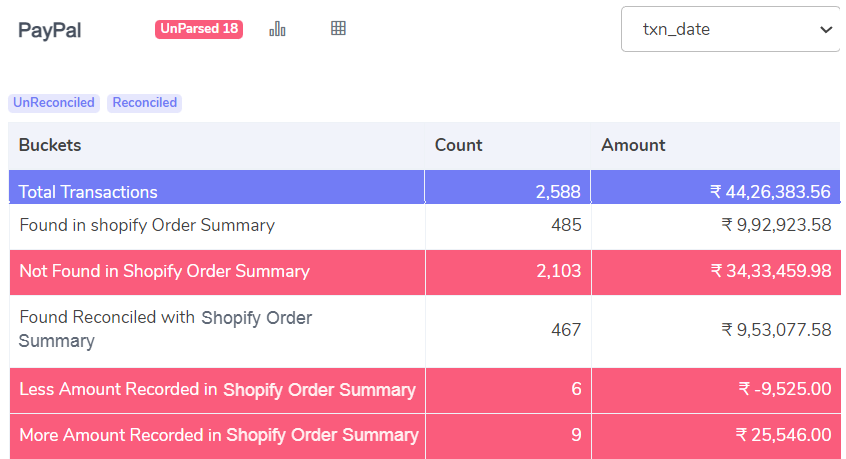

Payment Gateway with Website Reconciliation

The software compares the payment gateway report with the internal website reports to show the following result.

This explanation breaks down the results of reconciling your Shopify order summary with your payment gateway and internal reports.

Found and Reconciled:

These transactions are the good news! They appear in both your payment gateway and internal reports with matching amounts. This means everything is in sync for these orders.

Not Found in Shopify Order Summary:

These transactions are a red flag. They exist in the payment gateway report, but not in your internal reports. This could indicate missing orders in Shopify or duplicated entries in the payment gateway.

Less Amount Recorded in Shopify Order Summary:

For these transactions, a discrepancy exists. The amount recorded in your internal reports is lower than what the payment gateway shows. This could be due to reasons like discounts or refunds applied in Shopify that weren’t reflected in the payment gateway report.

More Amount Recorded in Shopify Order Summary:

Here, the opposite happens. The internal reports show a higher amount than the payment gateway. This might be caused by mistakes like typos or reversed charges in Shopify that weren’t reflected in the payment gateway report.

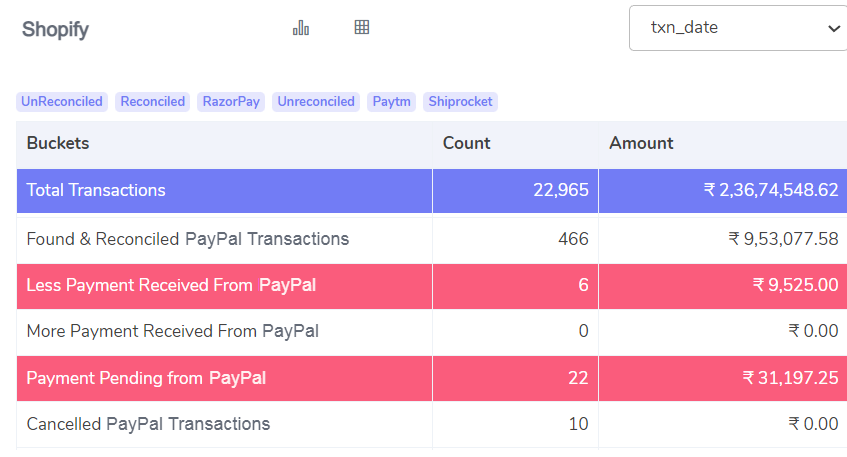

Website with PayPal Reconciliation

The software compares the website’s internal report with the PayPal report to check if the website order payments are made by Paypal correctly.

This breakdown clarifies the results of reconciling your website orders with your PayPal transactions.

Matched Transactions:

These are your successful orders! They appear in both your internal website report and the PayPal report with matching amounts. Everything is reconciled and accounted for.

Discrepancies in Amount:

Lower Amount in PayPal:

Here, the website report shows a higher order value than PayPal. This could be due to discounts, taxes, or shipping charges applied on your website that weren’t reflected in PayPal.

Higher Amount in PayPal:

This indicates the opposite scenario. The PayPal report shows a higher transaction value than your website. This might be caused by mistakes like typos or additional fees charged by PayPal that weren’t reflected on your website.

Cancelled Orders:

These transactions were placed on your website but were subsequently cancelled by the customer according to the PayPal report. You should investigate these cancellations to understand customer behavior and identify any potential issues with your website or products.

PayPal Reconciliation with ERP

Our software compares the PayPal report with the ERP report to verify all orders and their payment recorded.

This explanation clarifies the results of reconciling your payment gateway transactions with your ERP system.

Matched Transactions:

Great news! These transactions appear in both the payment gateway report and your ERP system with matching amounts. This indicates everything is synced and accounted for.

Discrepancies in Amount:

Lower Amount in ERP:

Here, the payment gateway shows a higher transaction value compared to your ERP. This could be due to reasons like additional fees charged by the payment gateway that weren’t reflected in the ERP.

Higher Amount in ERP:

This scenario shows the opposite. The ERP system reflects a higher amount than the payment gateway. This might be caused by mistakes like typos or additional charges recorded in the ERP that weren’t reflected in the payment gateway report.

Missing Transactions:

These transactions are a red flag. They exist in the payment gateway report but are missing from your ERP system. This could indicate missing entries in your ERP or duplicated entries in the payment gateway.

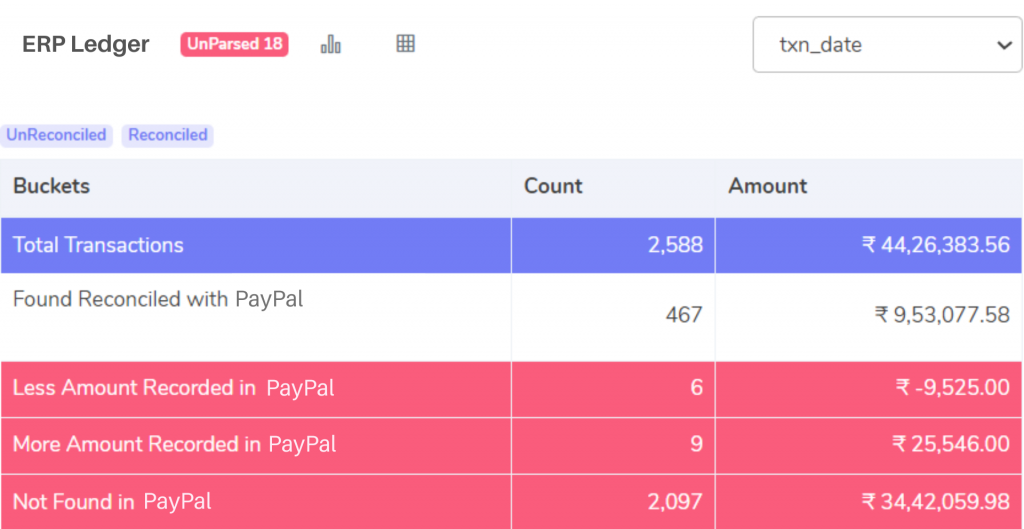

ERP with PayPal Reconciliation:

This breakdown clarifies the results of reconciling your ERP system with your PayPal transactions.

Matched Transactions:

These are your successful reconciliations! The transactions appear in both your ERP system and the PayPal report with matching amounts. Everything is reconciled and accounted for accurately.

Discrepancies in Amount:

Lower Amount in PayPal:

Here, the ERP report shows a higher value for the transaction compared to PayPal. This could be due to reasons like additional charges or refunds processed through your ERP that weren’t reflected in PayPal.

Higher Amount in PayPal:

This scenario indicates the opposite. The PayPal report shows a higher transaction value than your ERP. This might be caused by mistakes like typos or fees charged by PayPal that weren’t reflected in the ERP system.

Missing Transactions:

These transactions are a red flag. They exist in your ERP system but are missing from the PayPal report. This could indicate missing entries in PayPal or duplicated entries in your ERP. You should investigate these discrepancies to ensure accurate financial records.

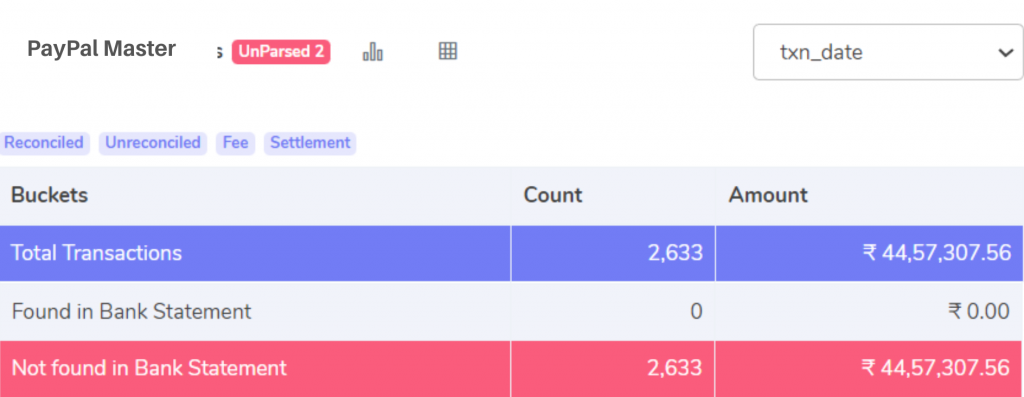

PayPal with Bank Reconciliation

The software compares the PayPal report with the bank statement to check if the payments have been correctly sent to your bank account.

This explanation clarifies the results of reconciling your bank statement with your PayPal report.

Matched Transactions:

These transactions are a sign-off! They appear in both your PayPal report and bank statement, indicating successful receipt of payment from PayPal for these orders.

Unmatched Transactions:

These transactions require attention. They exist in the PayPal report but are missing from your bank statement. This could mean:

Delayed Deposits:

Sometimes, there might be a delay between when PayPal marks a payment as complete and when the funds appear in your bank account. Check for deposits within the next few business days.

Missing Entries:

There’s a chance the transfer from PayPal wasn’t recorded properly. Investigate further by contacting PayPal or reviewing your account activity for any failed transactions.

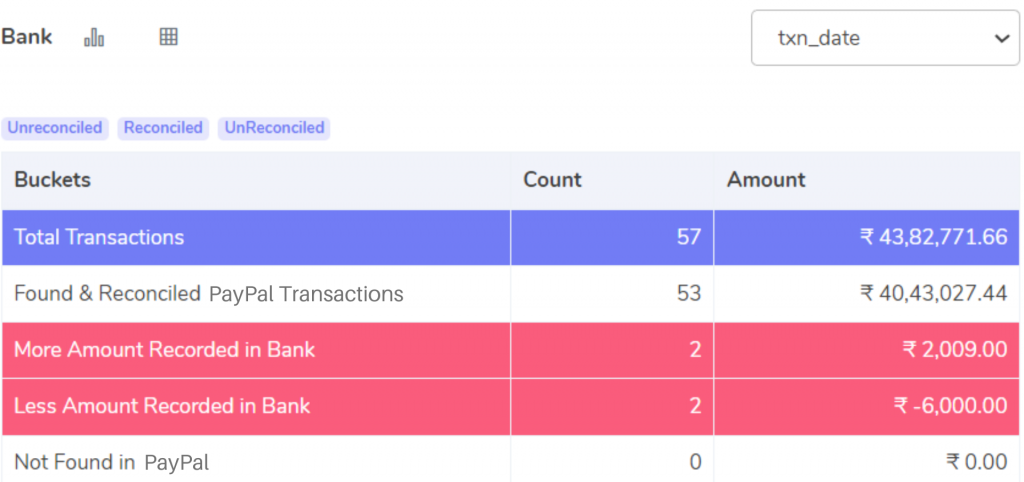

Bank Reconciliation with PayPal

This breakdown clarifies the results of reconciling your bank statement with your PayPal report for transactions.

Matched Transactions:

These are your successful deposits! The transactions appear in both your PayPal report and bank statement with matching amounts, confirming that PayPal correctly deposited the payment for these orders into your bank account.

Discrepancies in Amount:

Higher Amount in Bank:

This scenario might indicate a pleasant surprise! The bank statement shows a higher deposit than the PayPal report for some transactions. This could be due to potential refunds or adjustments made by PayPal that weren’t reflected in the initial report. However, it’s important to investigate further to confirm the reason.

Lower Amount in Bank:

Here, there might be a discrepancy that requires attention. The bank statement shows a lower deposit amount compared to the PayPal report. This could be due to reasons like:

Fees:

PayPal might have deducted fees from the transaction that weren’t reflected in the initial report.

Chargebacks:

A customer might have initiated a chargeback on a purchase, resulting in a reversal of funds from PayPal.

Bank Errors:

There’s a slight chance of an error in your bank statement. You can confirm this by contacting your bank.

Tired of manually reconciling your PayPal transactions with website orders, ERP, and bank statements?

Cointab Reconciliation streamlines the entire process, freeing your team for more strategic tasks. Here’s how:

Effortless Invoice Management:

Automatic Knock-Off Reports:

Our software automatically identifies paid orders and creates corresponding reports for your ERP system.

No More Manual Work:

Say goodbye to the tedious task of manually removing paid invoices. Cointab ensures your ERP data stays accurate and up-to-date.

Streamlined Reconciliation:

Automated Uploads and Matching:

Forget about uploading individual files and manually matching transactions. Cointab automates the entire process, saving you valuable time and resources.

Reconcile Everything:

Gain a complete financial picture by reconciling your PayPal transactions with website orders, ERP data, and bank statements.

Enhanced Financial Controls:

Proactive Monitoring:

Easily identify discrepancies like underpayments or missing payments from PayPal.

Dispute Resolution:

With clear reconciliation reports, you can efficiently raise disputes with PayPal to claim any outstanding amounts.

Transform Your Reconciliation Process:

Cointab Reconciliation empowers your business to:

Increase Efficiency:

Automate time-consuming tasks and free your team to focus on higher-level activities.

Improve Accuracy:

Eliminate manual errors and ensure your financial data is always reliable.

Gain Control:

Gain a clear understanding of your financial health with comprehensive reconciliation reports.

Ready to experience the power of automated PayPal reconciliation? Try Cointab Reconciliation today!