In today’s digital age, small and medium-sized businesses seek seamless solutions for managing financial transactions. Square, developed by Block, Inc., emerges as a leading financial services platform offering an array of tools tailored for businesses. From facilitating credit card payments to transforming phones and tablets into efficient point-of-sale systems, Square revolutionizes the way businesses handle transactions.

Understanding Square’s Role:

Square serves as both a point-of-sale (POS) system and a payment processor, boasting its own payment solution. Additionally, it provides a complimentary online store feature seamlessly integrated with Square payments.

Challenges in Transaction Verification:

Despite the convenience Square brings, businesses often face challenges in verifying transactions manually. This manual process not only consumes significant time but may also result in inaccuracies, potentially impacting financial insights.

Introducing Automated Solutions:

Enter Cointab Reconciliation Software, an automated solution designed to streamline transaction verification processes, particularly those involving Square transactions. By leveraging automated software, businesses can efficiently verify transactions and promptly address any discrepancies that may arise.

Understanding Square Reports:

To comprehend the significance of automated reconciliation software, it’s crucial to understand the various Square reports involved:

Square Settlement Reports:

These reports detail orders placed and payments processed.

Square Return Reports:

Providing insights into refunded payments for canceled orders.

Website Reports:

Offering data on customer orders placed through the online store.

ERP Reports:

Internal reports presenting item-wise information.

Bank Statements: Summarizing transactions received via payment gateways.

Key Reconciliation Scenarios:

Automated reconciliation software helps address various scenarios encountered during transaction verification:

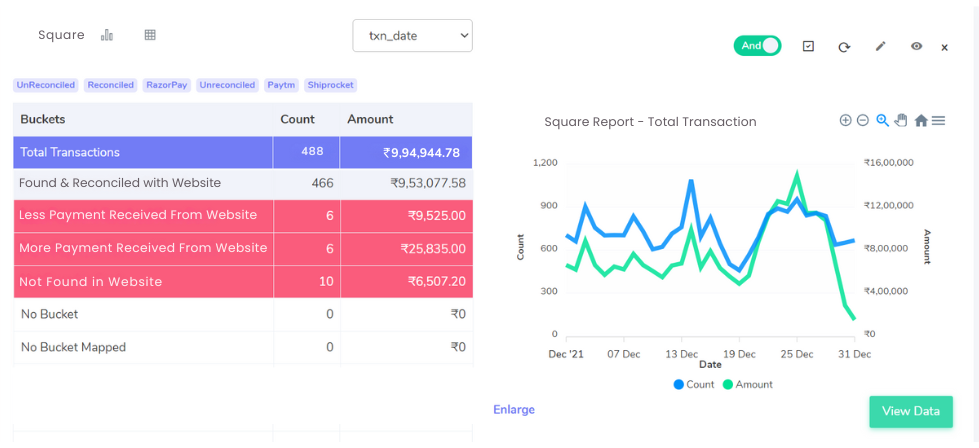

Square with Payment Reconciliation:

Present on Website Report:

Transactions are duly recorded and mirrored across both Square settlement reports and website reports, ensuring comprehensive financial tracking and accountability.

Absent on Website Report:

Despite being documented within Square settlement reports, certain transactions are notably absent from corresponding website reports. This emphasizes the significance of meticulous cross-referencing to capture all financial activities across digital platforms.

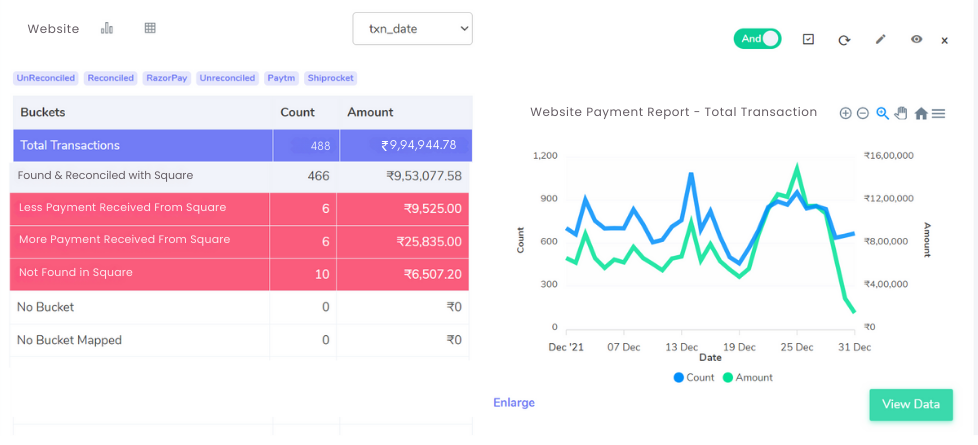

Website with Square Reconciliation:

Found and Reconciled with Website Report:

Transactions undergo meticulous reconciliation processes across both website and Square settlement reports, ensuring comprehensive accuracy in financial documentation.

Discrepancy: Less/More Amount Recorded in Website Report:

Discrepancies in recorded amounts between website and Square settlement reports may manifest in either lesser or greater figures. Addressing these variations is paramount to maintaining financial integrity and precision across online platforms.

Cancelled Transactions:

Orders documented within website reports may be subject to cancellation by customers, resulting in their absence from Square settlement reports. This highlights the necessity of accounting for canceled transactions to ensure a complete and accurate financial record.

Streamline your Financial Reconciliation Now!

Request a Demo!

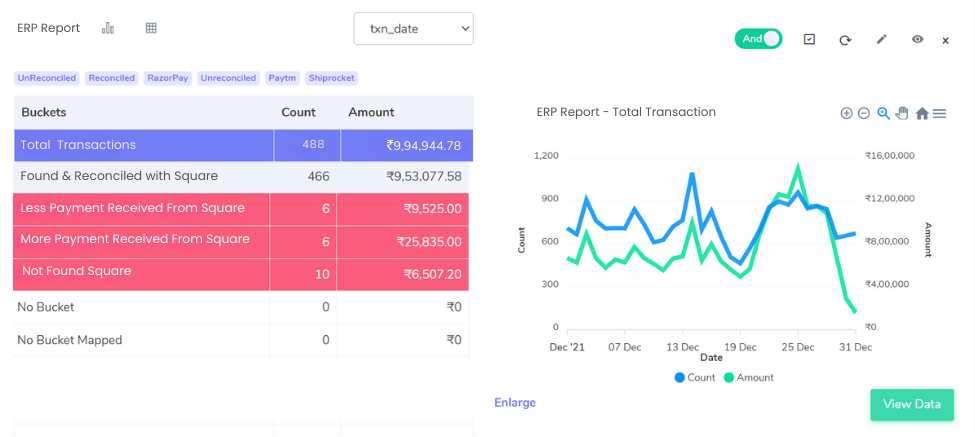

Identifying Transactions on ERP and Square Settlement Reports:

Found and Reconciled with ERP Reports:

Transactions are meticulously cross-referenced and reconciled across both ERP and Square settlement reports, ensuring comprehensive accuracy in financial documentation.

Discrepancy: Less/More Amount Recorded on ERP Reports:

Discrepancies in recorded amounts between ERP and Square settlement reports may manifest in either lesser or greater figures. Addressing these variations is crucial to maintaining financial integrity and precision.

Not Found on ERP Reports:

Transactions documented within Square settlement reports but conspicuously absent from ERP reports underscore the importance of thorough cross-verification processes. This ensures all financial activities are duly captured and reconciled across platforms for comprehensive oversight.

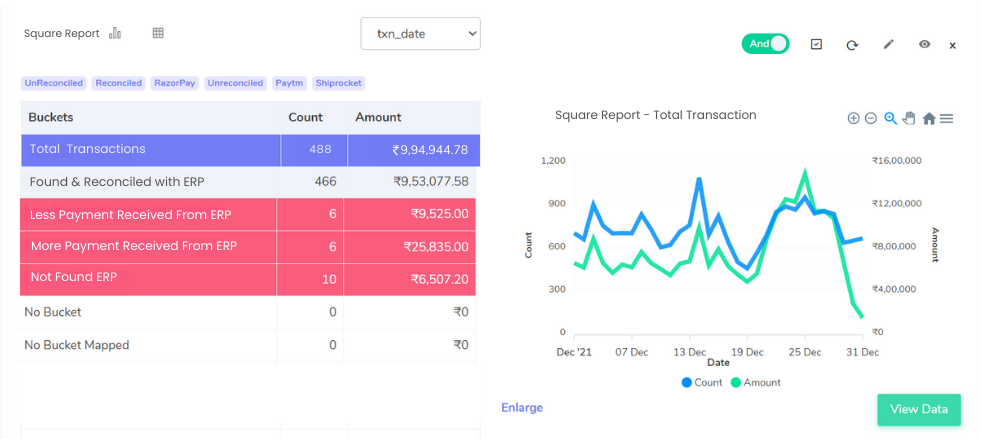

Identifying Transactions on ERP and Square Settlement Reports:

Found and Reconciled with Square Settlement Report:

Transactions undergo thorough matching processes across both ERP and Square settlement reports, ensuring alignment and accuracy in financial documentation.

Discrepancy: Less Amount Recorded on Square Settlement Report:

Instances may arise where the recorded amount on Square settlement reports appears lower when compared to figures documented in ERP reports. This variance necessitates careful scrutiny to maintain consistency and integrity in financial records.

Discrepancy: More Amount Recorded on Square Settlement Report:

Conversely, discrepancies may occur wherein the amount documented on Square settlement reports surpasses that recorded in ERP reports. Addressing such disparities is essential to uphold financial accuracy and transparency.

Not Found on the Square Settlement Report:

Certain transactions, while documented in ERP reports, may not be reflected within Square settlement reports. This divergence highlights the importance of cross-referencing multiple sources for comprehensive financial oversight and reconciliation.

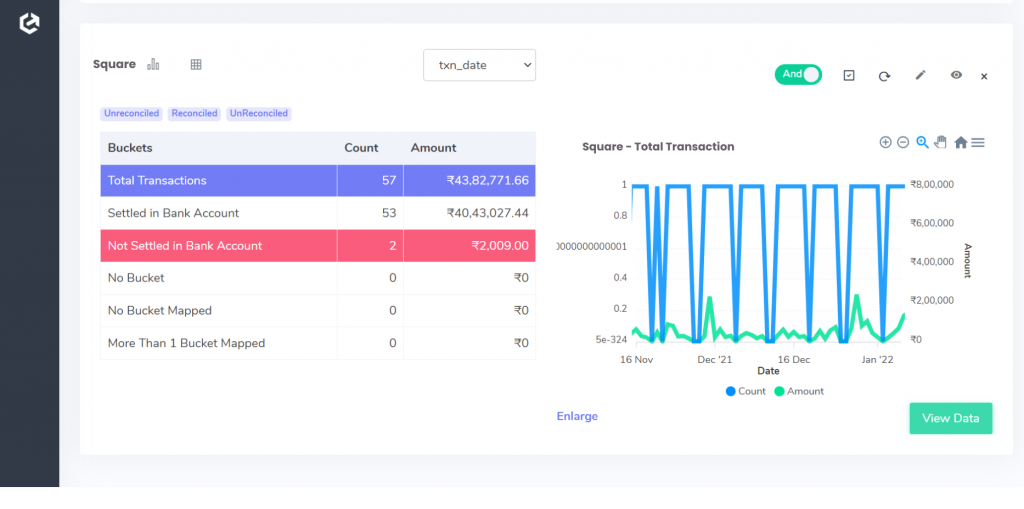

Square with Bank reconciliation:

Found in Bank Statement:

Transactions are readily identifiable within bank statements, serving as a primary source for tracking financial activity. Moreover, these transactions are mirrored in Square settlement reports, offering dual documentation for comprehensive record-keeping.

Not Found on Bank Statement:

While bank statements provide a wealth of transactional data, certain transactions are exclusive to Square settlement reports. This discrepancy underscores the necessity of consulting multiple sources to capture a complete picture of financial transactions.

Found and Reconciled with Square Settlement Report:

Effective reconciliation practices involve harmonizing transactions listed on bank statements with those detailed in Square settlement reports. This meticulous verification process ensures alignment between different financial documentation systems, enhancing accuracy and promoting robust financial management.

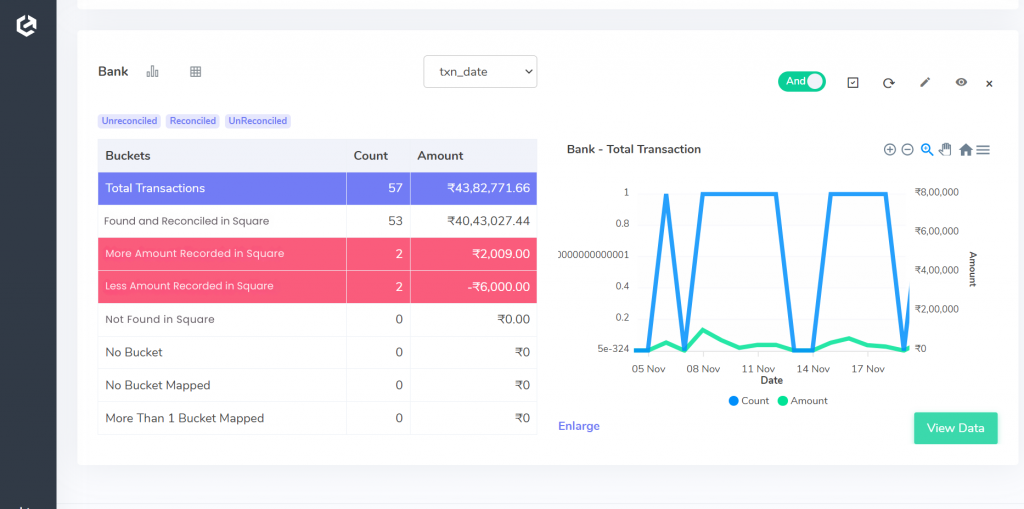

Bank reconciliation with Square:

Found and Reconciled with Square Settlement Report:

When transactions are found and reconciled with the Square settlement report, it indicates alignment between the bank statement and Square’s records.

More Amount Recorded on Square Settlement Report:

In instances where more funds are recorded on Square settlement reports compared to the bank statement, businesses may observe higher transaction amounts reflected in Square’s records.

Less Amount Recorded on Square Settlement Report:

Conversely, when the amount recorded on Square settlement reports is less than what appears on the bank statement, it suggests discrepancies in transaction amounts between the two records.

Not Found on the Square Settlement Report:

Transactions not found on the Square settlement report but present on the bank statement indicate inconsistencies between the two records, which require further investigation for reconciliation.

Benefits of Automated Reconciliation Software:

Implementing automated reconciliation software offers numerous advantages for businesses

Efficiency Enhancement:

By automating transaction verification processes, businesses can significantly reduce the time and effort expended by their finance teams.

Discrepancy Identification:

Automated software promptly identifies discrepancies in transactions, enabling businesses to address issues promptly.

Enhanced Accuracy:

Minimizing manual intervention decreases the likelihood of errors in transaction verification, ensuring financial data accuracy.

Time Savings:

Streamlining verification processes frees up valuable time for finance departments, allowing them to focus on strategic initiatives.

Improved Financial Insights: Accurate transaction data enables businesses to make informed decisions, driving growth and profitability.

In conclusion, automated reconciliation software emerges as a valuable asset for businesses seeking to streamline transaction verification processes, particularly those involving Square transactions. By leveraging technology to automate these processes, businesses can enhance efficiency, accuracy, and ultimately, financial performance. Embracing automated solutions not only mitigates the challenges associated with manual verification but also empowers businesses to unlock their full potential in an increasingly competitive landscape.