Providing customers with various payment options is recommended these days. Since there are so many options like UPI, Debit cards, Credit cards, etc. and different customers have different preferences. Credit cards are preferred by customers due to the various rewards and cashback offers provided by the banks. The process of receiving payments on credit card transactions is complicated, every business must keep accurate track of every transaction. To keep such an accurate track reconciliation is required. Cointab has made an automated reconciliation software that does the reconciliation of American Express card instore transactions easily and accurately. The software has many features such as automation of data load in various formats, and easy configuration of logic to clean and extract data into simple results which can be easily analyzed and downloaded.

Credit card Transactions

Batches of authorized transactions are sent by retailers to their payment processors. The payment processor sends transaction information to the card associations, which then coordinate the necessary debits with the network’s issuing banks. The sum of the transactions is charged to the cardholder’s account by the issuing bank.

Reports Required for Reconciliation

Client Sales Report

This report contains the sales data of all the different stores of a vendor. It contains the sum of the sales done according to the payment method used.

American Express Report

When payments are received from the partner the details of the transaction are recorded in this report.

Bank Statement

The bank statement contains all the transactions involving the payments toward the bank account.

Reconciliation of Individual Stores

Reconciliation is necessary to keep an accurate track of the payment that is being received in the bank. The software links the reports, compares the summaries, and generates a result. This Result is displayed in a very easy-to-read format. Merchants can easily determine and keep a track of the payments received and can also find out where they haven’t received the payment accurately and if some payments are yet pending.

The above result displays the data of every individual store. The software summarizes the data and shows the following

Credit Card Sales:

The total sales whose payments were received via a credit card are recorded here

CC Sales HDFC

For Payments done via an HDFC EDC, the amount reflects in this line item.

CC Sales (AMEX)

Payments are done using an American Express EDC.

Sales Variance

The Total Card Sales are subtracted from HDFC and AMEX Sales and are recorded in this line item.

Deduction (HDFC)

When receiving payment via the HDFC EDC there are some charges.

Deductions (Amex)

Deductions while receiving payments via an American Express EDC

Calculated Net Received

The total amount of Payments that should be received after necessary deductions are recorded in this line item.

Settlement (HDFC)

The settlement received via HDFC for the payments done via the HDFC EDC is recorded here.

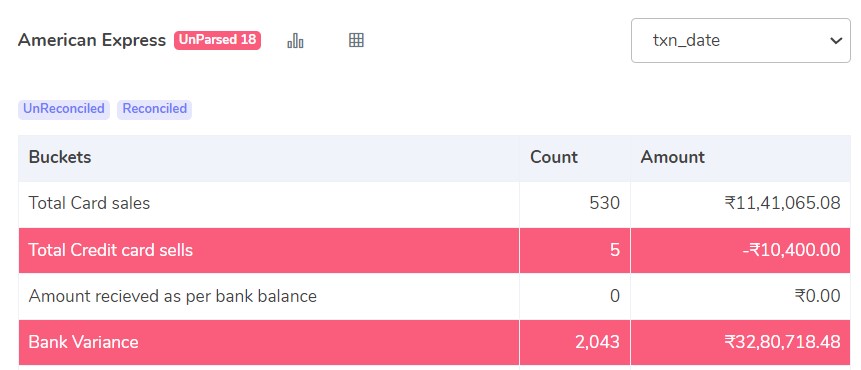

Reconciliation of all Stores

After individual store reconciliation, the software sums up the total transaction amounts and verifies the total amount in the bank statement. This helps the merchant keep a track of the total payments received, not received, and even pending. It helps in analyzing net receivables and net deductions. A merchant can then accurately know which store is recording less payments and can also pinpoint the exact transaction.

Total Card Sales

In this line item, the Total card Sales for one month from all the stores are recorded.

Total Credit Card Sales

If the Total Credit card Sales for one month from all the stores are recorded here.

Amount Received as per Bank Statement

The amount that is received in the bank statement as Card payments is recorded here.

Bank Variance

The difference between the Total card Sales and the amount received in the Bank Statement is recorded here.

The software does reconciliation of American Express instore transactions very easily. A business can automate the data upload and easily and readily view the results when needed. The results help the business keep an accurate tab on the sales done and payments received through which partner and also the net income of each store and all stores. The software accommodates automated data load in any format (XLSX CSV, PDF, etc.) which saves any form of manual effort. The summarized result is accurate and can be analyzed easily to make data-driven decisions for the business.