CRED offers an exclusive selling platform for premium brands, providing access to a niche customer base known for high-value purchases. However, the financial operations behind selling—such as commission deductions, promotional charges, refund adjustments, and payout settlements—can be intricate. Without a structured reconciliation process, sellers may face revenue inconsistencies due to inaccurate fee calculations and delayed payments. Cointab’s automated reconciliation solution helps CRED sellers maintain accurate financial records, preventing revenue loss and improving financial transparency.

Challenges of Cred Reconciliation

Cred presents unique reconciliation hurdles

High-Volume Transaction Management

CRED Marketplace primarily caters to high-end brands, meaning sellers deal with fewer but higher-value transactions. Given the significant revenue per order, even minor discrepancies in commission fees, refunds, or chargebacks can lead to substantial financial losses.

Multiple Payment Processing Challenges

CRED Marketplace transactions are processed through premium payment options, including credit cards, UPI, and reward-based redemptions. Ensuring accurate reconciliation across multiple payment modes is crucial for financial clarity.

Refund and Return Reconciliation

CRED often offers exclusive cashback deals and flexible return policies. Sellers must ensure that refunds are processed correctly, cashback deductions are aligned with agreed terms, and returns are not leading to unintended financial losses.

Commission and Marketing Fee Variations

CRED charges dynamic commission rates depending on the brand category, promotional agreements, and premium listing fees. Sellers participating in discount offers and loyalty-based promotions face additional charges, making it crucial to verify deductions to avoid revenue losses

Delayed and Partial Payouts

CRED follows a structured payout cycle, but payments may be impacted by refund adjustments, promotional fee deductions, and other financial factors. Sellers need a system to track and verify whether all payments are received as expected.

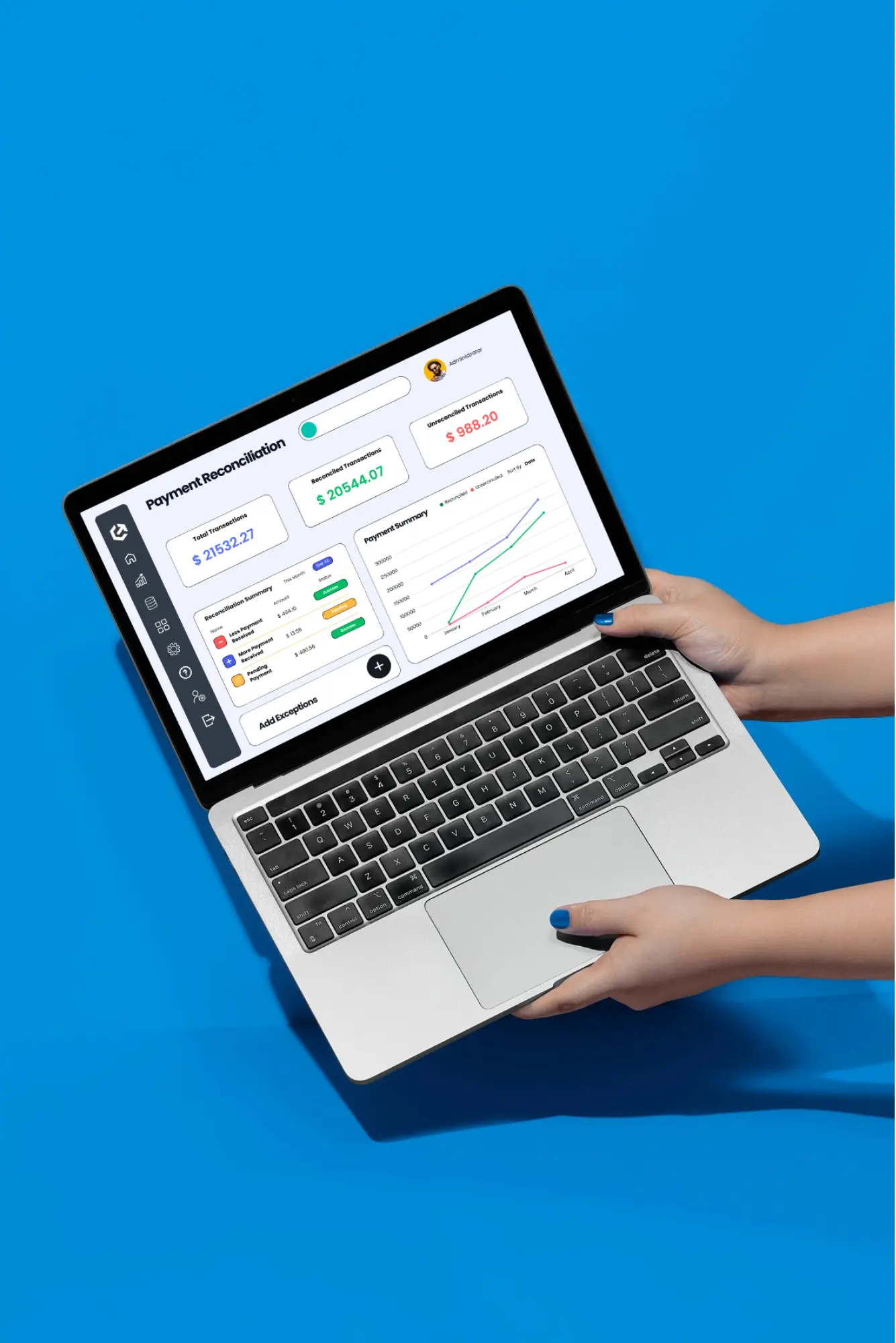

How Cointab Simplifies Cred Reconciliation

Cointab’s automated reconciliation software streamlines Cred financial management:

Seamless Integration

Cointab connects with CRED’s platform to automatically fetch transaction data, ensuring accurate reconciliation of payments, refunds, and fees without manual effort.

Refund and Return Management

Cointab monitors refund transactions to ensure only valid claims are processed, preventing financial losses due to over-refunds or incorrect settlements.

Payout Reconciliation

The system matches CRED’s payout reports with expected earnings, identifying any missing or delayed payments and helping businesses resolve issues proactively.

Automated Fee and Commission Reconciliation

It verifies CRED’s commission charges, platform fees, and promotional deductions to ensure businesses are not overcharged, flagging discrepancies for corrective action.

Comprehensive Reporting

Cointab provides detailed financial reports, offering businesses complete visibility into transactions, settlements, and deductions for improved financial decision-making.

Cointab's Solution for Cred Reconciliation

Automated Fee and Commission Verification

The system cross-checks CRED’s commission charges, transaction fees, and promotional deductions to prevent overcharges. Any discrepancies are automatically flagged for quick resolution.

Direct Integration with CRED’s Payment System

Cointab seamlessly integrates with CRED’s platform to fetch transaction data in real time. This eliminates manual data entry and ensures accurate reconciliation of payments, refunds, and fees.

Refund and Return Accuracy Check

Cointab tracks refunds and chargebacks to validate their legitimacy, ensuring businesses are not impacted by incorrect or excessive refund processing. It provides detailed reports to highlight mismatches.

Detailed Financial Insights for Better Decision-Making

Cointab generates comprehensive reports with a breakdown of revenue, fees, refunds, and settlements, giving businesses complete financial transparency and control over their reconciliation process.

Payout Reconciliation and Discrepancy Identification

By comparing expected payouts with actual disbursements, Cointab helps businesses identify missing, delayed, or incorrect payments. Sellers receive automated alerts to take corrective actions promptly.

Key Stats on Cred Reconciliation

78% of premium online sellers report financial losses due to unverified deductions and refund errors

70% of return disputes result in revenue discrepancies due to incorrect cashback and promotional deductions

Automated reconciliation improves financial accuracy by 72%, reducing manual effort and ensuring better revenue tracking

Conclusion

CRED provides sellers with access to a premium audience, but managing financial transactions requires a robust reconciliation system. Manual tracking of commissions, refunds, and payouts often leads to errors, missed payments, and revenue losses. Cointab’s automated reconciliation solution ensures sellers receive accurate payouts, track every transaction efficiently, and maintain complete financial transparency.

Switch to Cointab today—because financial reconciliation should never slow your business down.