Facilitating seamless digital transactions is paramount in contemporary commerce, where cashless operations dominate. Payment gateways serve as pivotal conduits for swift and efficient transactions, benefiting consumers and businesses alike. Among these gateways, Shopify Pay emerges as a premier solution, simplifying online payment acceptance and alleviating complexities associated with third-party providers. With e-commerce expansion and heightened expectations for frictionless transactions, integrating Shopify Pay enhances user experience, fosters customer retention, and drives satisfaction.

Handling millions of transactions daily, manual scrutiny proves impractical, necessitating automated reconciliation solutions. Cointab fills this need, seamlessly integrating to automate reconciliation and promptly identify irregularities, ensuring financial accuracy and integrity.

Efficient reconciliation hinges on accessing and correlating various reports essential for auditing and verification. Aligning Shopify Pay reports with internal records—website reports, ERP data, and bank statements—ensures consistency and accuracy across financial records.

Key Reports Essential for Shopify Pay Reconciliation:

Shopify Pay Settlement Report:

Detailing completed orders and corresponding payments.

Shopify Pay Return Report:

Recording refunded orders from cancellations.

Website Report:

Outlining customer order specifics directly from the website’s database.

ERP Report:

Providing internal item-wise information crucial for reconciliation.

Bank Statement:

Detailing transactions facilitated through Shopify Pay, reflected in the organization’s bank records.

By meticulously comparing these reports, discrepancies are promptly identified and rectified, ensuring financial transparency and compliance.

Shopify Pay Payment Gateway Reconciliation Results:

Successful reconciliation between Shopify Pay and internal systems is paramount for financial integrity and operational efficiency. Through seamless integration and automated reconciliation facilitated by Cointab, businesses achieve.

Accuracy Assurance:

Automating reconciliation flags discrepancies promptly, ensuring financial data accuracy.

Time Efficiency:

Leveraging automated tools expedites the process, reallocating resources to core activities.

Compliance Adherence:

Accurate reconciliation ensures regulatory compliance, safeguarding against penalties.

Enhanced Decision-Making:

Reliable financial data empowers informed decisions, fostering growth and sustainability.

Integrating Shopify Pay and leveraging automated reconciliation tools like Cointab streamlines payment processing, fortifying financial integrity and ensuring long-term business success in the digital landscape.

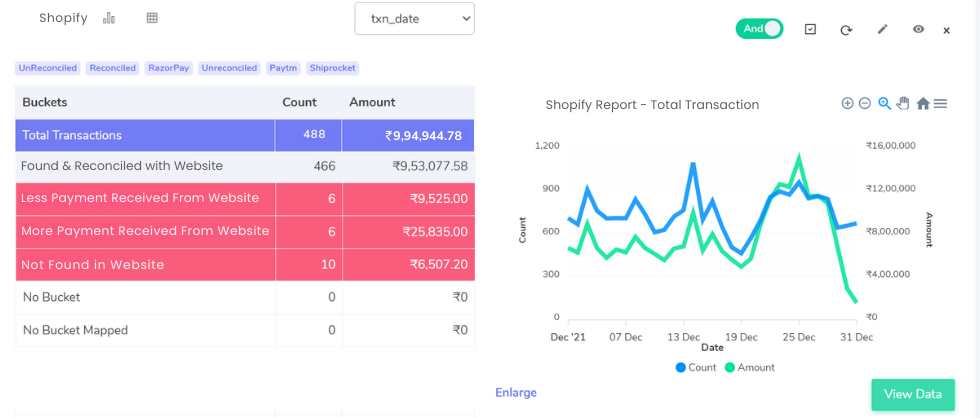

Shopify Pay with Website Reconciliation

Discovered within Shopify Order Summary:

This section encompasses transactions outlined in both Shopify Pay reports and website reports, providing a comprehensive overview of completed orders.

Omitted from Shopify Order Summary:

This segment highlights transactions documented solely within website reports but absent in Shopify Pay order reports, warranting attention for reconciliation.

Discovered and Harmonized with Shopify Order Summary:

Transactions successfully reconciled between website reports and Shopify Pay reports, ensuring alignment and accuracy across financial records.

Underreported Amount in Shopify Order Summary:

Instances where the recorded amount in website reports falls short compared to corresponding figures in Shopify Pay reports, necessitating investigation for discrepancies.

Overreported Amount in Shopify Order Summary:

This category denotes instances where website reports indicate higher figures than those in Shopify Pay reports, indicating potential errors or discrepancies warranting further scrutiny.

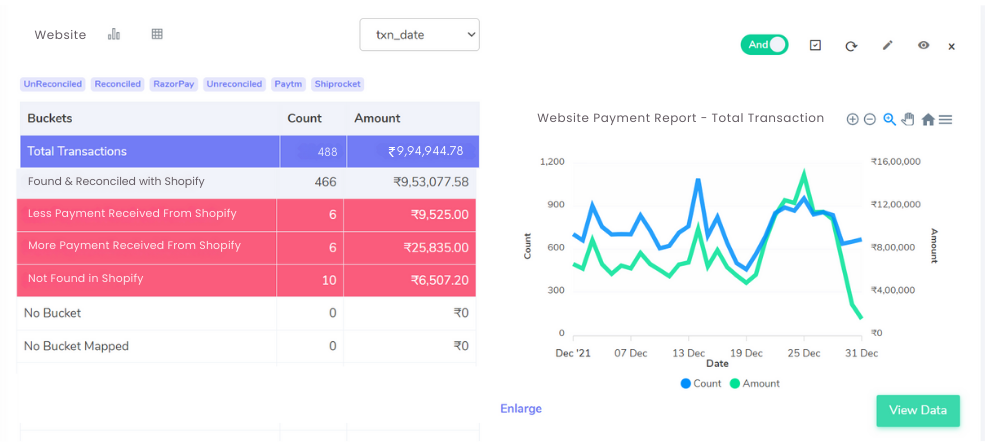

Website with Shopify Pay Reconciliation

Discovered and Aligned with Shopify Pay:

This category encompasses transactions successfully identified and harmonized within both the website report and Shopify Pay report, ensuring seamless financial reconciliation.

Underreported Amount in Shopify Pay:

Instances where the recorded amount within Shopify Pay reports falls below the figures documented in website reports. Addressing such discrepancies is crucial for maintaining financial accuracy and integrity.

Overreported Amount in Shopify Pay:

Contrary to underreported instances, this classification refers to cases where the amount documented in Shopify Pay reports exceeds that of the corresponding figures in website reports. Identifying and rectifying such discrepancies is essential to uphold financial transparency.

Cancelled Transactions:

Transactions falling under this classification are initially recorded within website reports but are subsequently canceled by the customer, resulting in their exclusion from Shopify Pay reports. Proper documentation and reconciliation of these transactions are vital for accurate financial reporting and analysis.

Streamline your Financial Reconciliation Now!

Request a Demo!

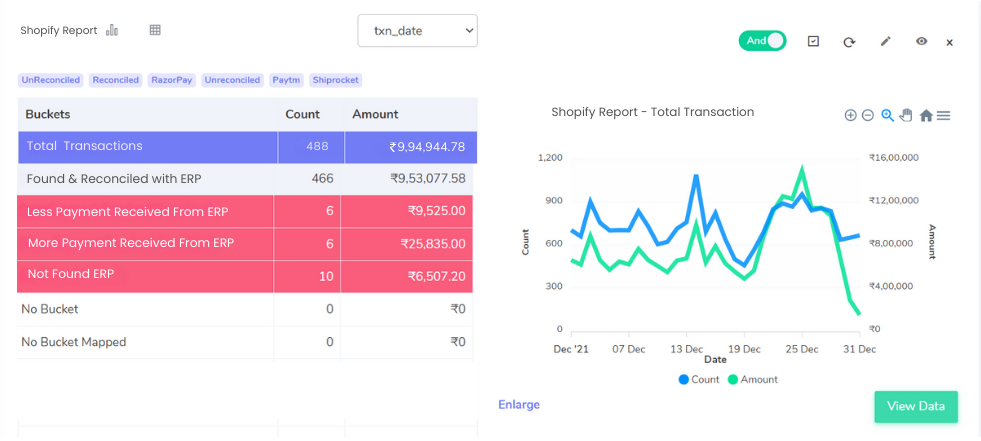

Shopify Pay Reconciliation with ERP:

This process involves aligning Shopify Pay transaction data with Enterprise Resource Planning (ERP) systems, ensuring coherence and accuracy across various organizational records. By reconciling Shopify Pay data with ERP reports, businesses can streamline financial management processes and enhance operational efficiency.

Identified and Aligned with ERP:

This category denotes transactions successfully matched between the website report and ERP reports. Ensuring coherence between these crucial financial documents is paramount for accurate accounting and informed decision-making.

Underreported Amount in ERP:

Instances where the amount documented within ERP reports falls short compared to the figures recorded in Shopify Pay reports. Addressing such discrepancies promptly is essential to maintain financial accuracy and integrity, preventing potential losses or misinterpretations.

Overreported Amount in ERP:

Conversely, this classification pertains to situations where the amount documented in ERP reports surpasses that of the corresponding figures in Shopify Pay reports. Identifying and rectifying such disparities is crucial to uphold financial transparency and prevent erroneous conclusions in financial analysis.

Not Found in ERP:

Transactions falling under this category are those absent from ERP reports despite being documented within Shopify Pay reports. Proper documentation and reconciliation of these transactions are vital to ensure comprehensive financial reporting and analysis, minimizing the risk of oversight or mismanagement.

Optimizing SEO Keywords for Enhanced Visibility:

Incorporating strategic SEO keywords can significantly enhance the visibility and accessibility of content, ensuring it reaches its intended audience effectively. By strategically integrating relevant keywords and phrases throughout the content, businesses can improve their search engine rankings and attract more organic traffic to their platforms.

Utilizing SEO-friendly language and structure, the following elaboration on each category aims to maximize content relevance and searchability:

Identified and Harmonized with ERP Systems:

This classification denotes transactions successfully matched and synchronized between the website report and Enterprise Resource Planning (ERP) systems. The seamless alignment of these critical financial documents is indispensable for accurate accounting practices and facilitating informed decision-making processes within organizations.

Underreported Amounts in ERP Records:

Instances where the monetary values documented within ERP reports fall short in comparison to the corresponding figures recorded in Shopify Pay reports. Promptly addressing such discrepancies is imperative to maintain financial precision and integrity, mitigating the risk of potential financial losses or misinterpretations.

Overreported Amounts in ERP Records:

Conversely, this category encompasses scenarios wherein the monetary values documented in ERP reports exceed those reflected in Shopify Pay reports. Identifying and rectifying such disparities is essential to uphold financial transparency and prevent erroneous conclusions during financial analysis and reporting processes.

Transactions Not Reflected in ERP Systems:

These transactions encompass those documented within Shopify Pay reports but are conspicuously absent from ERP records. Proper documentation and reconciliation of these transactions are pivotal to ensure comprehensive financial reporting and analysis, minimizing the likelihood of oversight or mismanagement within organizational financial processes.

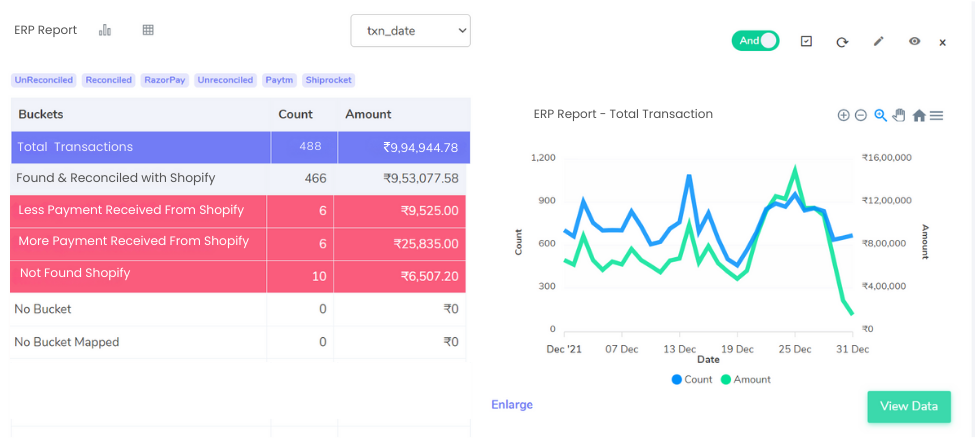

ERP with Shopify Pay Reconciliation

Discovered and Aligned with Shopify Pay:

These transactions signify those successfully identified and synchronized within Shopify Pay reports, ensuring seamless financial reconciliation.

Underreported Amount in Shopify Pay:

Instances where the monetary values recorded within Shopify Pay reports fall short compared to those documented in ERP reports. Addressing such disparities promptly is crucial to maintain financial precision and integrity, mitigating the risk of potential financial losses or misinterpretations.

Overreported Amount in Shopify Pay:

Conversely, this category encompasses scenarios wherein the monetary values recorded in Shopify Pay reports exceed those reflected in ERP reports. Identifying and rectifying such disparities is essential to uphold financial transparency and prevent erroneous conclusions during financial analysis and reporting processes.

Not Found in Shopify Pay:

These transactions refer to those documented within ERP reports but are conspicuously absent from Shopify Pay records. Proper documentation and reconciliation of these transactions are pivotal to ensure comprehensive financial reporting and analysis, minimizing the likelihood of oversight or mismanagement within organizational financial processes.

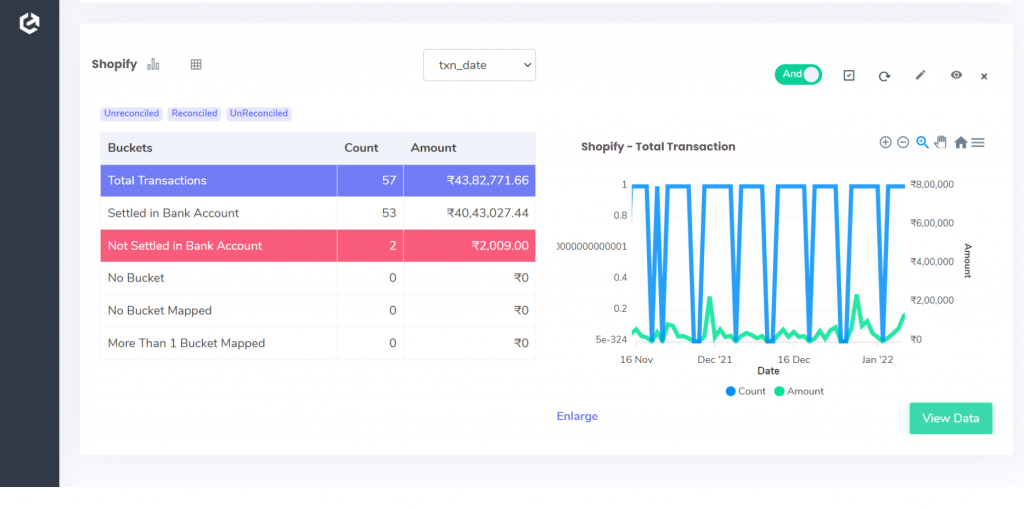

Shopify Pay with Bank Reconciliation:

Discovered in Bank Statement:

These transactions encompass those found both on the bank statements and within the Shopify Pay report, providing comprehensive financial insight and alignment.

Absent from Bank Statement:

These records denote transactions documented within the Shopify Pay report but conspicuously missing from the bank statement records. Proper documentation and reconciliation of these transactions are vital to ensure comprehensive financial reporting and analysis, minimizing the risk of oversight or mismanagement within organizational financial processes.

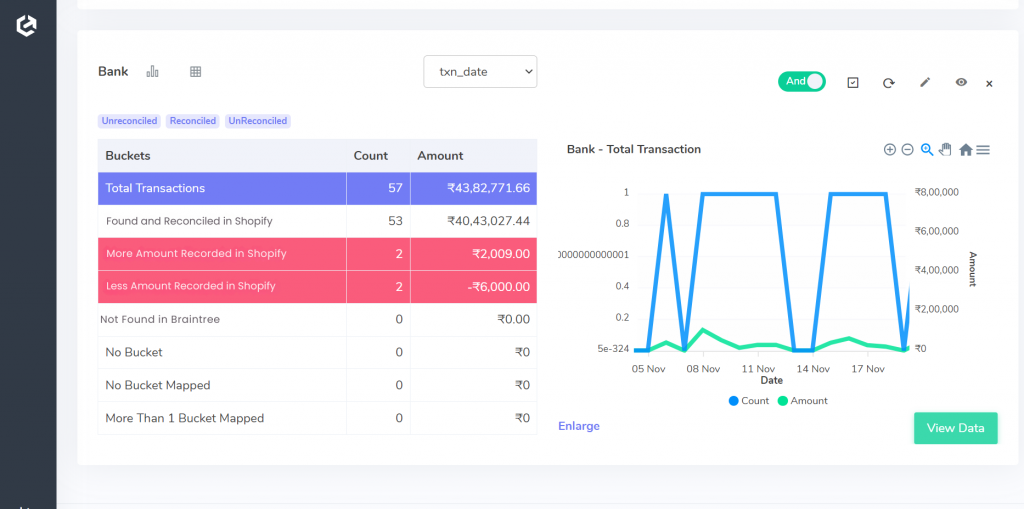

Bank with Shopify Reconciliation:

Discovered and Harmonized with Shopify Pay:

Unveiling transactions successfully reconciled within Shopify Pay, ensuring financial cohesion and accuracy.

More Amount Recorded in Shopify Pay:

Observing instances where the recorded amount within Shopify Pay surpasses that reflected in the bank statement. Rectifying such disparities is crucial for financial transparency and integrity.

Less Amount Recorded in Shopify Pay:

Identifying cases where the recorded amount within Shopify Pay falls short compared to the figures documented in the bank statement. Addressing such discrepancies promptly is essential for precise financial reporting.

Not Found in Shopify Pay:

Highlighting transactions documented within the bank statement but conspicuously absent from Shopify Pay reports. Proper reconciliation of such transactions is vital to ensure comprehensive financial documentation and analysis.

Cointab Reconciliation software stands as a pivotal solution in streamlining transaction verification processes, offering unparalleled efficiency through its automation capabilities. Particularly in industries handling substantial transaction volumes, such as the e-commerce realm exemplified by Shopify Pay’s millions of daily transactions, manual cross-checking becomes impractical and time-consuming.

Cointab’s automated reconciliation not only expedites the process but also swiftly identifies any discrepancies, ensuring financial accuracy and integrity in a matter of minutes. By leveraging this software, organizations can effectively conserve valuable human resources and optimize time allocation towards core business activities.

To experience the transformative efficiency of Cointab Reconciliation software and streamline your organization’s financial processes, take action today. Embrace automation, enhance accuracy, and reclaim valuable time by integrating Cointab into your business operations. Start your journey towards streamlined reconciliation and optimized resource utilization – schedule a demo now!

Step into the future of reconciliation. Fill out the form to request your demo now!