Welcome to the realm of seamless digital transactions facilitated by Fondy, the London-based payment gateway and premier provider of online payment solutions. Specializing in streamlining e-commerce experiences, Fondy is committed to enhancing customer satisfaction by making online shopping quick, convenient, and delightful for all. Our mission is to revolutionize the way businesses handle transactions, ensuring a smooth and stress-free checkout process that leaves a lasting impression on customers.

At the core of Fondy’s offerings lies simplicity and control. Setting up our payment gateway is a breeze, granting merchants unparalleled autonomy while ensuring that customers enjoy a frictionless checkout journey. With Fondy, businesses gain unprecedented control over payment flows, allowing them to manage transactions efficiently and effectively.

Empowering Businesses with Financial Control

Fondy empowers businesses by simplifying payment management and offering robust control over financial transactions. Through a single API integration, merchants can seamlessly accept payments from customers and disburse funds to partners, all within a seamlessly embedded financial infrastructure.

However, the benefits of partnering with Fondy come with certain associated charges. After each customer transaction, a portion of the payment is allocated towards these charges, with the remainder transferred to the merchant’s business account. Despite Fondy’s commitment to transparency, discrepancies in charges may occasionally arise, leading to either undercharges or overcharges.

Transparent Verification through Detailed Reports

To ensure transparency and accuracy in every transaction, Fondy provides merchants with comprehensive reports for verifying payment charges. These reports serve as invaluable tools for reconciling transactions and resolving any discrepancies that may arise. Key reports include:

Fondy Payment Report:

This report provides merchants with a detailed overview of all transactions processed through Fondy, including total transaction volumes and the modes through which transactions were carried out.

Fondy Rate Card:

The rate card outlines the various payment modes supported by Fondy, along with the associated fees and percentages charged for each mode.

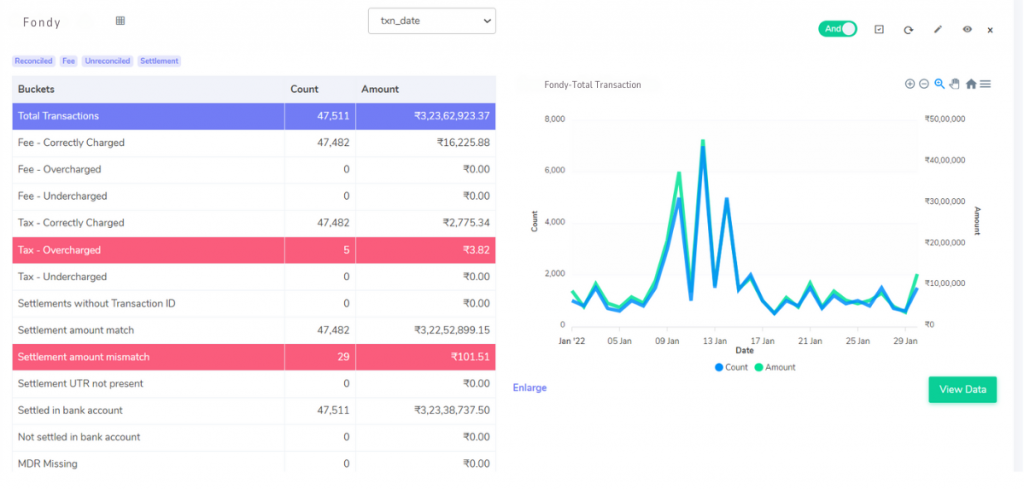

Interpreting Transaction Results for Seamless Operations

Efficiently analyzing Fondy payment reports requires a thorough understanding of the results and their implications. Merchants can interpret these results as follows:

Fee Correctly Charged:

Transactions align with the fee amounts specified in the Fondy Rate Card, indicating accurate charging.

Fee Overcharged:

The fees deducted from transactions exceed the amounts specified in the Fondy Rate Card, suggesting potential discrepancies that require investigation.

Fee Undercharged:

Charges deducted from transactions are lower than the amounts specified in the Fondy Rate Card, signaling possible undercharging that needs to be addressed.

Tax Correctly Charged:

Taxes recorded in the payment report match the tax amounts calculated as per GST guidelines, ensuring compliance with regulatory requirements.

Tax Overcharged/Undercharged:

Taxes recorded in the payment report deviate from the expected amounts, indicating potential errors in tax calculation that need to be rectified.

Settlement Amount Match/Mismatch:

Merchants should verify whether the settlement amounts calculated align with the amounts received from Fondy reports, ensuring accuracy in financial reconciliation.

Settlement UTR Presence:

Confirming the presence or absence of Unique Transaction Reference (UTR) numbers in settlement reports can facilitate seamless reconciliation with bank statements.

Settlement in Bank Account:

Matching settlement UTRs with bank statements confirms successful fund transfers, while discrepancies may indicate potential issues that need to be addressed.

Simplifying Reconciliation with Automation

Manual reconciliation of transactions can be time-consuming and prone to errors. Leveraging automated reconciliation software such as Cointab can significantly streamline this process, reducing the burden on finance teams and enhancing overall efficiency. In the event of discrepancies or overcharges, the insights gleaned from Fondy’s reports can help merchants promptly address any issues and seek resolution with Fondy’s support.

Unlocking Effortless Transactions with Fondy and Cointab

Fondy and Cointab together offer businesses a powerful combination of seamless payment processing and automated reconciliation. By simplifying financial operations and enhancing efficiency, merchants can focus on growing their businesses while ensuring that transactions are handled accurately and transparently.

Experience the ease and convenience of managing online payments with Fondy and Cointab. Simplify your financial processes, amplify your efficiency, and embark on a seamless journey towards business success with our comprehensive suite of payment solutions and reconciliation tools.