Establishing an online store can pose significant challenges, particularly for small enterprises. Many business owners opt to delegate these tasks to focus on their core competencies. This is where platforms like Shopify prove invaluable. Shopify facilitates the creation of online stores, granting businesses the means to establish a digital presence. Furthermore, ensuring the security of an e-commerce platform can be arduous and time-intensive. Utilizing Shopify for security purposes can offer a more reliable solution compared to self-setup, which demands substantial investment and expertise in digital marketing and e-commerce. Achieving optimal security levels may require months or even years of effort. Shopify’s popularity stems from its comprehensive features, such as one-click purchasing, customizable options, and accessible customer service. Users can explore these features during a 14-day trial period before selecting a subscription plan tailored to their business needs from the three available options. While Shopify simplifies the process of creating online stores, managing different payment gateways and cash on delivery (COD) vendors can pose challenges for finance departments. Verifying reports from various vendors within the Shopify ecosystem may lead to human errors or consume valuable time in ensuring the accuracy of transactions.

Problems Encountered in Website Reconciliation Process

Considering the challenges encountered in website reconciliation, companies require a streamlined solution. Therefore, they can utilize Cointab’s software, which seamlessly links Shopify, any Order Management System, Payment Gateway, COD vendors, and the bank, generating a comprehensive report from various perspectives. This integration facilitates effortless reconciliation of all payments, presenting information in a user-friendly format while ensuring easy access to pertinent data.

Pros of using the Cointab Software for Website Reconciliation

- Connecting reports from diverse vendors

- Validating payments and orders

- Automated generation of the final outcome

- Offering technical support

- Simplified sharing of reports with the entire team

Reconciliation Process

Scope / Entities

- Shopify

Customers frequently visit the Shopify site to peruse potential purchases. Upon selecting a product, they proceed to their shopping cart and are then directed to checkout. At this stage, they have the option to pay instantly online using credit or debit cards, or opt for cash on delivery if available. Shopify diligently generates reports to monitor and record each transaction.

- EasyEcom order management system

EasyEcom efficiently tracks all orders originating from the Shopify website, alongside monitoring payments processed by both the Payment Gateway and COD partners. Our software facilitates the reconciliation of EasyEcom’s reports with those from the Payment Gateway and COD partners.

- Payment gateway

A payment gateway software enables transactions through various methods like debit cards, credit cards, and net banking. Our software reconciles the payment gateway report with EasyEcom’s report and the bank statement to ensure accuracy in payments made.

- COD remittance

Cash on Delivery (COD) is another payment option, typically managed through COD vendors who transfer received payments to the company’s bank account. Our software reconciles the COD remittance report with EasyEcom’s report and the bank statement to verify the accuracy of payments.

- Bank Statement

Bank statements are crucial for verifying whether the payments expected from COD or Payment Gateway partners are deposited into the company’s bank account. Cointab’s software reconciles the bank account with internal reports, EasyEcom’s report, Payment Gateway report, and COD remittance report to confirm the correctness of payments or identify any discrepancies.

Reports Used For Reconciling:

- Shopify order report

This report documents all orders placed on the Shopify website within a specific timeframe and is utilized for reconciliation against the EasyEcom order report.

- EasyEcom order report

This report keeps a record of all the orders placed on the Shopify website which are recorded by the EasyEcom order management system. It is used to reconcile all orders against the Shopify Order Report.

- EasyEcom Sales tax report

This report is completed during order dispatch and details the applicable sales tax for each transaction.

- EasyEcom Return tax report

This report documents tax information for products returned by customers (returns or RTOs).

- EasyEcom Cancellation tax report

It records tax details for orders that were initially placed but later cancelled.

- EasyEcom SKU master

This document maintains records of stocked products, including relevant details for each SKU.

- Payment gateway settlement report

Used for reconciliation with bank statements and the EasyEcom report, this report outlines settlements made through the payment gateway.

- Payment gateway rate card

A comprehensive tax rate card indicating the taxes applicable to purchases made via the payment gateway.

- COD remittance reports from courier partner

These reports track payments made by customers using the Cash on Delivery method, which the COD partner must remit to the company.

- Bank statements

Bank statements are scrutinized to verify whether payment gateway or COD partners have fulfilled their financial obligations to the company’s bank account.

Reconciliation Result:

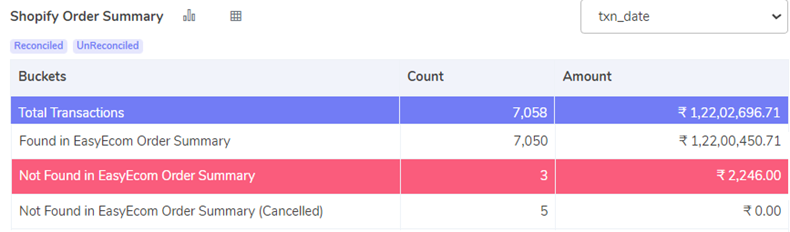

Shopify vs EasyEcom Reconciliation

Forward Reconciliation

Found in EasyEcom Order Summary-

In this section of our software, the Shopify report is cross-referenced with the EasyEcom report. The orders that match and are present in both reports are displayed here. These are fulfilled orders for which the company will receive payment.

Not Found in EasyEcom Order Summary-

This segment of our software compares the EasyEcom report with the Shopify report. Orders that are absent in the EasyEcom report but are found in the Shopify report are listed here. These orders will not be processed as they were not included in the EasyEcom report. Therefore, it’s imperative for the organization to review these orders carefully.

Not Found in EasyEcom Order Summary (Cancelled)-

Our software conducts a comparison between the EasyEcom and Shopify reports. Orders that are absent in the EasyEcom report and were subsequently cancelled are depicted in this section. Although these orders will not be fulfilled due to their absence in the EasyEcom report, they pose no concern as they were cancelled afterward.

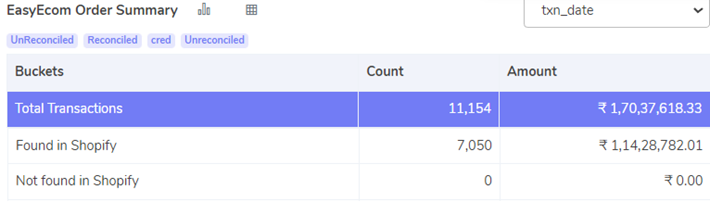

Backward Reconciliation

Found in Shopify Order Summary-

This section of our software compares the EasyEcom report with the Shopify Report. Orders that match and are present in both reports are displayed here. These are fulfilled orders for which the company will receive payment.

Not Found in Shopify Order Summary-

In this segment, orders that did not originate from the Shopify site are highlighted. The software identifies completed orders for which payment will not be received. This is emphasized to prompt the company to review these orders.

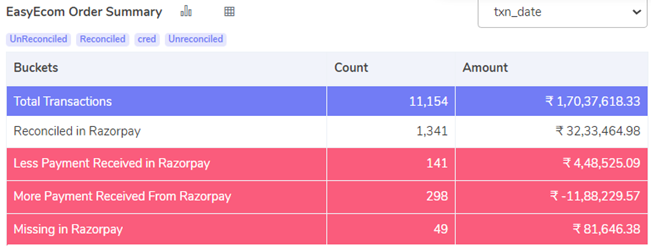

EasyEcom vs Payment Gateway (example: Razorpay)

Forward Reconciliation

Reconciled in Payment Gateway:

Our software compares the EasyEcom report with the Payment Gateway report, confirming that the transactions recorded by EasyEcom and the payment gateway align perfectly. This section ensures transparency, assuring your business that all payments processed through the payment gateway have been received.

Less Payment Received in Payment Gateway:

By comparing the EasyEcom report with the Payment Gateway report, Cointab’s software identifies instances where payments have not been received in full. If the sales amount in EasyEcom exceeds the recorded amount in the payment gateway, it indicates a shortfall in received funds compared to expectations from the Payment Gateway partner.

More Payment Received from Payment Gateway:

This section indicates that the amount recorded in EasyEcom is lower than the amount recorded in the payment gateway. Being aware of this disparity in advance allows the company to promptly refund the excess amount and provide expedited support to customers.

Missing in Payment Gateway:

Orders listed in this bucket are not documented in the payment gateway report, indicating that while these orders were fulfilled, payment was not processed by the payment gateway. It’s crucial for the organization to meticulously review these orders.

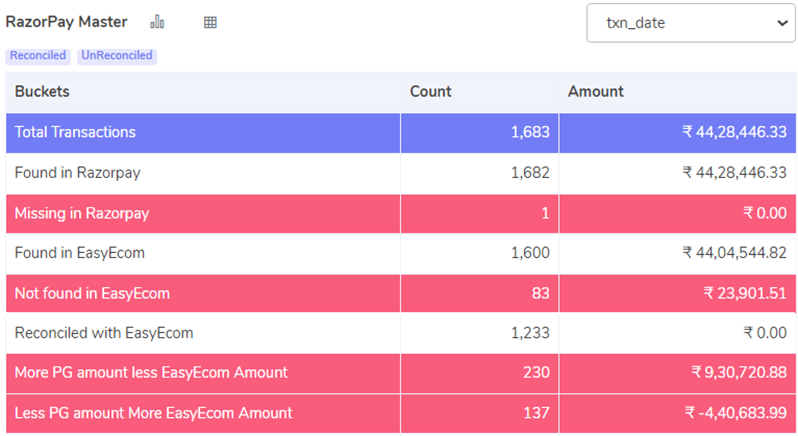

Backward Reconciliation

Found in Payment Gateway:

This section displays prepaid orders for which payment will be received from the payment gateway partner.

Missing In Payment Gateway:

Cointab’s software compares the Payment Gateway Report with the EasyEcom report, revealing orders absent from the payment gateway report. This segment showcases prepaid orders awaiting payment from the payment gateway partner.

Found in EasyEcom:

Our software compares the Payment Gateway Report with the EasyEcom report, highlighting orders present in EasyEcom. These prepaid orders indicate that the payment gateway partner has fulfilled the required payment.

Not Found In EasyEcom:

Cointab’s software compares the Payment Gateway Report to the EasyEcom Report, identifying orders absent from EasyEcom. This section displays prepaid orders that will not be completed, but for which the payment gateway partner is expected to make payment. It’s essential for the organization to carefully review these orders to avoid losing clients.

Reconciled with EasyEcom:

Our software compares the Payment Gateway Report with the EasyEcom report, showcasing orders identical in both reports. This feature assures the company of accurate payments made.

More Payment Gateway amount Less EasyEcom amount:

Cointab’s software compares the Payment Gateway Report with the EasyEcom report, indicating orders for which the payment gateway has disbursed more funds than required.

Less Payment Gateway amount More EasyEcom amount:

Cointab’s software compares the Payment Gateway Report with the EasyEcom report and shows the orders for which less amount is recorded in the payment gateway report than in the EasyEcom report. This means that the payment gateway has made less amount of payment than required so the company has to keep a track of the amount pending.

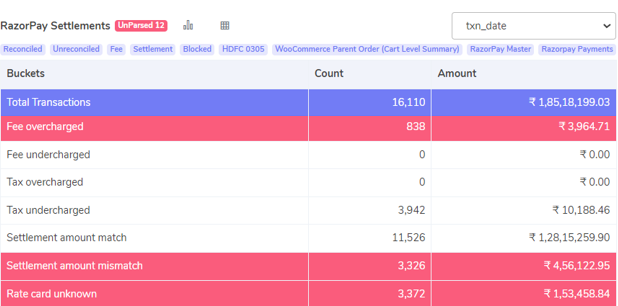

Payment Gateway Fee Verification

Fee Overcharged:

Our software identifies instances where the fee imposed by the Payment Gateway partner surpasses the agreed-upon amount in the business contract. This feature serves as a warning mechanism, alerting the company to potential overcharges and enabling them to avoid unnecessary payments.

Fee Undercharged:

This section of our software reveals transactions where the fee assessed by the Payment Gateway is lower than the agreed-upon amount. It informs the company of the shortfall in charges, ensuring compliance with the contract terms.

Tax Overcharged:

Cointab’s software flags transactions wherein the tax applied by the Payment Gateway exceeds the contractual amount. The system cross-validates the tax against the rate card, calculating and presenting any overcharged amounts in this section.

Tax Undercharged:

This segment displays transactions where the tax levied by the Payment Gateway is less than the agreed-upon amount, calculated at 18% of the fee charged. The system cross-checks this against the rate card, indicating any instances of undercharged tax.

Settlement Amount Match:

For transactions, the system calculates the settlement amount by subtracting fees and taxes from the collected amount. Rows where this calculated settlement amount matches the amount provided by the payment gateway directly are displayed as settlement amount match.

Settlement Amount Mismatch:

Using the aforementioned calculation method, this section flags transactions where the calculated settlement amount does not align with the amount provided directly by the payment gateway.

Rate Card Unknown:

This category showcases transactions where customers opted for payment through a consumer payment app not listed in the payment gateway partner’s rate card.

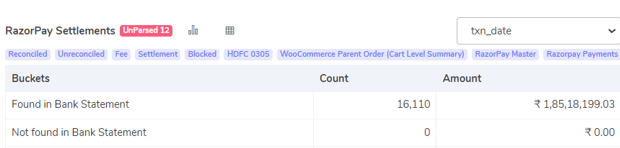

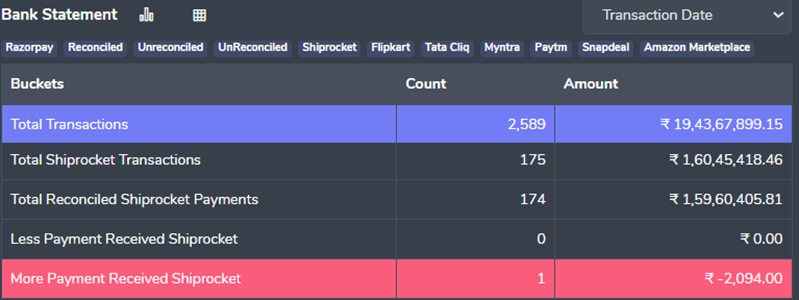

Payment Gateway vs Bank Statement

Forward Reconciliation

Found in Bank Statement:

This section displays transactions settled in the bank originating from the payment gateway partner. It aids in monitoring the actual amount received in the bank account for fulfilled orders.

Not Found in Bank Statement:

Here, transactions not settled in the bank from the payment gateway partner are listed. This assists in tracking the pending amount yet to be received in the bank account for fulfilled orders.

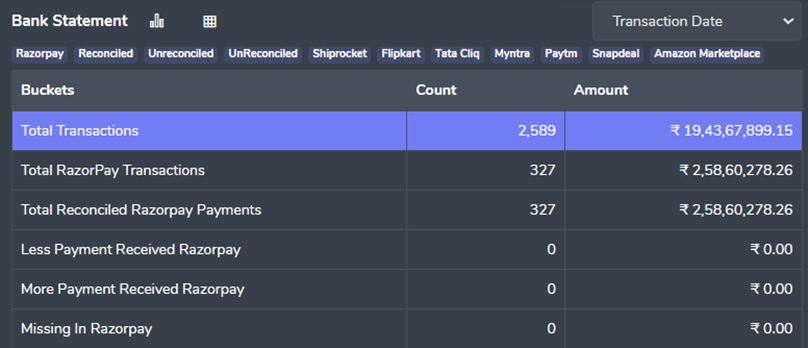

Backward Reconciliation

Total Payment Gateway Transactions:

This section displays the total number of transactions conducted through the payment gateway method, as recorded in the bank statement.

Total Reconciled Payment Gateway Payments:

Here, your company is presented with all purchase payments made via the payment gateway that have been successfully received in the company’s bank account.

Less Payment Received Payment Gateway:

Our software identifies orders for which the payments received are less than the expected amount from the Payment Gateway partner.

More Payment Received Payment Gateway:

This section highlights instances where the amount recorded in the bank statement is lower than the amount recorded by the payment gateway. It assists in identifying if the payment gateway has remitted more than the required amount, enabling the company to issue refunds if necessary.

Missing in Payment Gateway:

Transactions absent from the payment gateway report after comparison with the bank statement are listed in this section.

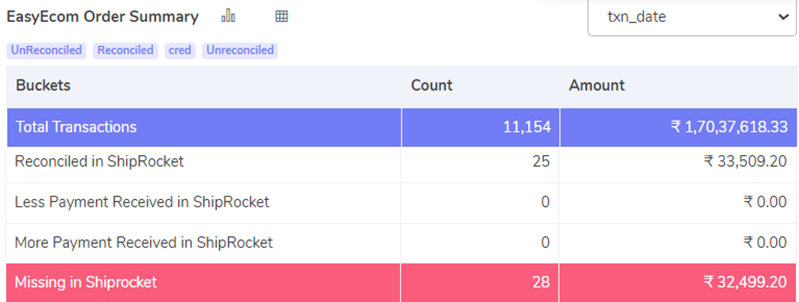

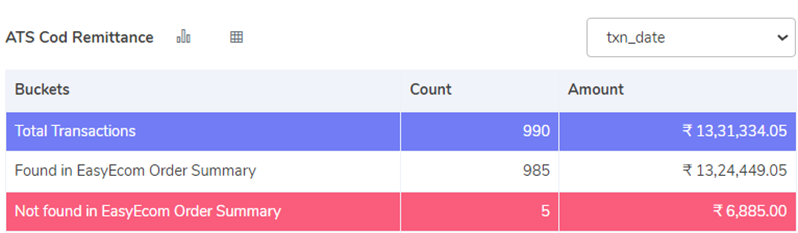

EasyEcom vs COD Remittance (Example: ShipRocket)

Forward Reconciliation

Reconciled with COD:

In this section, Cointab’s Software displays orders where the recorded amount in EasyEcom matches the amount recorded in COD remittance, indicating that these payments have been successfully reconciled.

Less Payment Received in COD:

Cointab’s Software identifies orders for which the amount recorded in EasyEcom exceeds the amount recorded in COD remittance. This suggests that the payments received are less than the expected amount from the COD partner.

More Payment Received in COD:

This section indicates instances where the amount recorded in EasyEcom is less than the amount recorded in COD remittance. It helps identify if customers have paid more via COD, enabling quicker resolution of customer issues if the company is aware of the discrepancy in advance.

Missing in COD:

Orders absent from the COD remittance report after comparison with the EasyEcom report are listed in this section. These are post-paid orders not recorded in the COD remittance, indicating that these payments are yet to be made by the COD partner.

Backward Reconciliation

Found in EasyEcom Order Summary

This section displays orders where the COD Remittance report matches the EasyEcom Software, indicating that these orders are completed and payment has been received from the COD partner.

Not found in EasyEcom Order Summary:

In this segment, orders absent from the EasyEcom Software despite being recorded in the COD Remittance report are listed. This indicates that these orders are not completed and do not exist in the EasyEcom system, yet payment has been received from the COD partner.

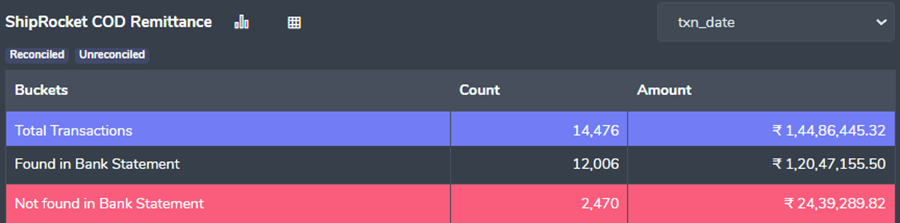

COD Remittance vs Bank Statement

Forward Reconciliation

Found in Bank Statement:

This section of our software compares the COD Remittance Report with the bank statement, indicating that the COD vendor has made payments to the company for completed orders.

Not Found in Bank Statement:

In this category, prepaid completed orders are listed for which the company has not received payment from the COD partner. This section is crucial as it informs the company about pending payments for these orders.

Backward Reconciliation

Total COD Transactions:

This section displays the total transactions recorded in the bank statement that were facilitated by the COD partner.

Total Reconciled COD Payments:

Cointab’s Software compares the Bank Statement with the COD remittance report, showcasing instances where the amounts match in both reports. This section illustrates payments made via the COD partner that were successfully received in the company’s bank account.

Less Payment Received COD:

By comparing the Bank Statement with the COD remittance report, Cointab’s Software identifies cases where the amount recorded in the Bank Statement is less than the amount recorded by the COD partner. This indicates that the payments received are less than the expected amount from the COD partner in the company’s bank account.

More Payment Received COD:

This section highlights instances where the amount recorded in the Bank Statement exceeds the amount recorded by the COD partner. It helps identify if the COD partner has remitted more than the required amount.

RECONCILIATION RESULT:

The above-given tables depict the reconciliation result achieved through the use of Cointab’s software. A comprehensive report is generated after analyzing various reports including the EasyEcom report, payment gateway report, COD remittance report, company’s internal report, and the bank statement. The result is presented in a user-friendly format, facilitating seamless reconciliation for the company’s finance teams. Cointab’s software enhances business operations efficiency and accuracy, making it an ideal solution for companies seeking optimization in their processes.